Trend Line is one of the most versatile tools in trading.

You can use it in day trading, swing trading or even position trading.

However, most traders get it wrong.

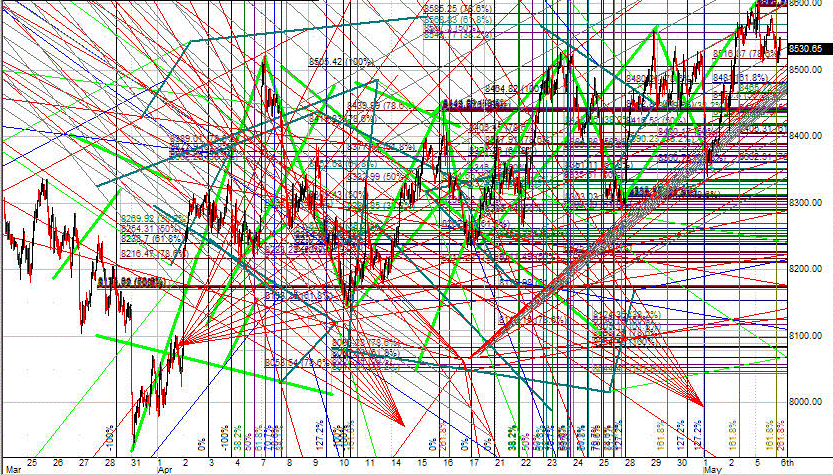

They draw Trend Lines looking like this…

I know I’m exaggerating, but you get my point.

That’s why in today’s post, you’ll learn:

- What is a Trend Line and how does it work

- How to draw a Trend Line correctly (that most traders never find out)

- How to use Trend Line to identify the direction of the trend — and tell when the market condition has changed

- How to use Trend Line to better time your entries

- The Trend Line Breakout strategy

- How to ride massive trends using a simple Trend Line technique

- How to use Trend Line and identify trend reversal

Or if you prefer, you can watch this training below…

What is a Trend Line and how does it work

You know Support and Resistance are horizontal areas on your chart that show potential buying/selling pressure.

And it’s the same for Trend Line.

The only difference is… a Trend Line isn’t horizontal but sloping.

Here’s a Trend Line example…

Infosys Daily Timeframe:

So here’s my definition of it:

Upward Trend Line: “Sloping” area on the chart that shows upward buying pressure.

Downward Trend Line: “Sloping” area on the chart that shows downward selling pressure.

Now before I dive into specific Trend Line strategies and techniques, you must first learn how to draw a Trend Line correctly.

And that’s what I’ll cover next.

So read on…

How to draw a Trend Line correctly

First, let’s learn how NOT to draw your Trend Line.

Here’s a bad example…

Apple Daily Timeframe:

Clearly, this is garbage.

How do you know which Trend Lines are important? And which to ignore?

You’ve no idea.

So listen carefully:

Here’s how to draw a Trend Line correctly…

1. Focus only on the major swing points and ignore everything else

2. Connect at least 2 major swing points

3. Adjust it so that you get the most number of touches (whether it’s body or wick)

Here’s a Trend Line example…

Amazon Daily Timeframe:

Amazon Daily Timeframe:

Pro Tip:

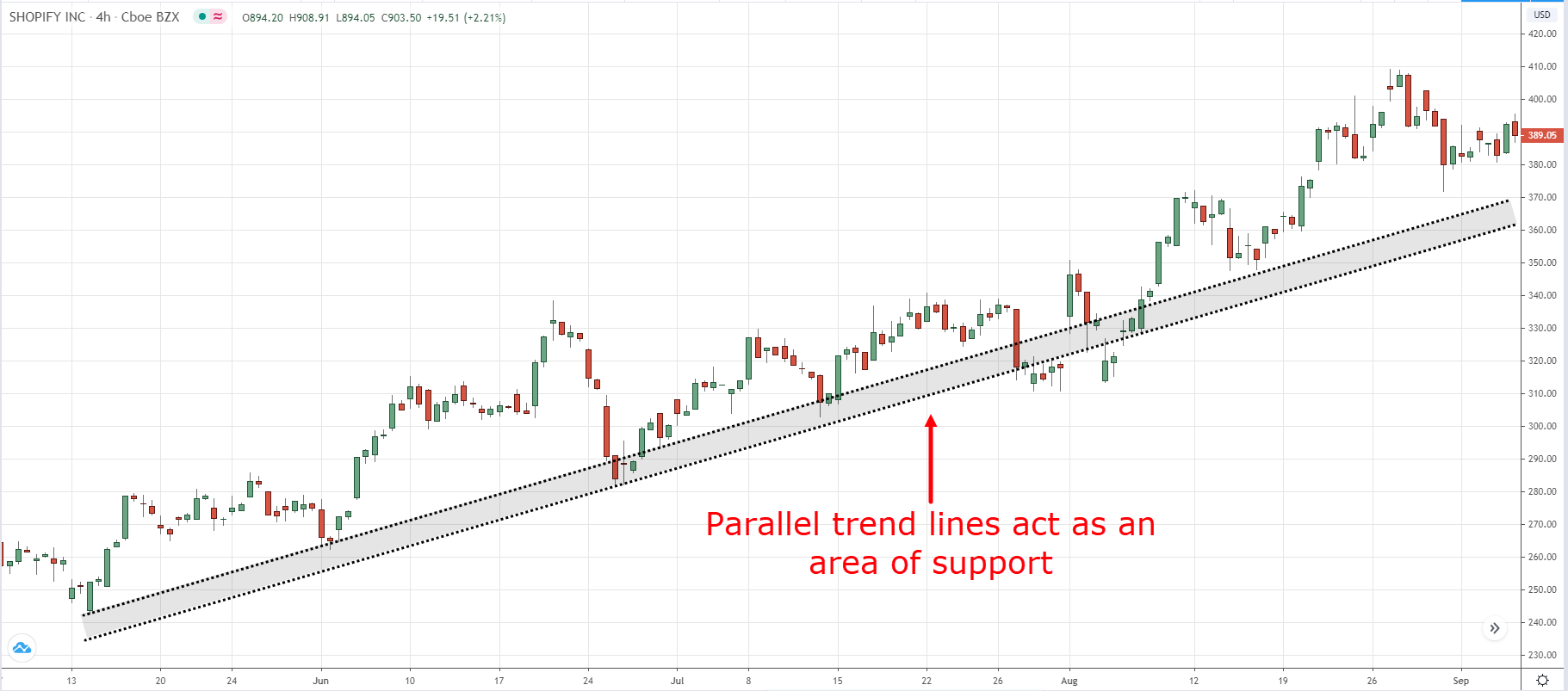

You can draw 2 parallel Trend Line to define the area on your chart.

Here’s an example…

Shopify 4-Hour Timeframe:

Now…

Unlike Support and Resistance where you can just draw once and leave it, Trend Line needs “adjustment”.

This happens when the price breaks the Trend Line and then recovers — and you need to “adjust” the Trend Line to fit the recent price action.

Moving on:

You’ll learn how Trend Lines can improve your trading results…

How to use Trend Line to identify the direction of the trend — and tell when the market condition has changed

All you need to do is draw your Trend Line and ask yourself…

“Is the Trend Line pointing higher or lower?”

If it’s higher, then the market is in an uptrend (and vice versa).

An example…

Apple 4-Hour Timeframe:

But that’s not all.

Because a Trend Line can also alert you when market conditions are changing.

How?

By paying attention to the steepness of the Trend Line.

For example:

If your Trend Line is getting flatter, it means the market is moving into a range condition.

And if your Trend Line is getting steeper, it means the trend is becoming stronger (or possibly going into a buying climax).

Is this important?

Heck yes!

Because if you know market conditions are changing, you can adjust your trading strategy accordingly.

And not use the same “trick” for all market conditions — which is a recipe for disaster.

Next…

Trend Line Trading: How to better time your entries

If you want to find good trading opportunities, then you must trade near the Trend Line.

This allows you to have a tighter stop loss on your trades — which improves your risk to reward.

But that’s not all…

Because if you combine Trend Line with Support and Resistance, that’s where you find the best trading opportunities.

Here’s what I mean…

Nvidia Daily Timeframe:

Now you might wonder:

“So when do I enter a trade?”

Well, you can use reversal candlestick patterns (like the Hammer, Bullish Engulfing, etc.) as your entry trigger.

This means you’re only entering a trade when the market has “bounced off” the Trend Line and likely to move higher.

Here’s an example…

Nvidia Daily Timeframe:

This is powerful stuff, right?

The Trend Line Breakout Strategy

Here’s the deal:

It can be difficult to time your entries in a trending market because the pullback can be deep or shallow.

I’ll explain…

If the pullback is deep and you enter your trades too early, you have to suffer a lot of “pain”.

But if the pullback is shallow and you enter your trades too late, you risk missing the move.

So, what’s the solution?

Introducing The Trend Line Breakout technique.

Here’s how it works…

1. Wait for a pullback in an uptrend

2. Draw a Trend Line connecting the highs of the pullback

3. If the price breaks the Trend Line, then enter the trade

Here’s an example…

Microsoft Daily Timeframe:

Here’s the logic behind it…

If the price breaks above the Trend Line, it tells you the buyers are in control and the trend is likely to resume.

If it doesn’t, then it means the sellers are still in control and you want to stay on the sidelines till the buyers regained control.

Does it make sense?

How to ride massive trends with this simple Trend Line technique

Here’s how:

1. Draw an upward Trend Line

2. Trail your stop loss below the Trend Line

3. Exit the trade if the price closes below the Trend Line

Here’s an example…

Shopify 4-Hour Timeframe:

However…

This technique won’t work well when the trend goes parabolic because you risk giving back a lot of open profits.

You’re wondering:

“How do I know when a trend is parabolic?”

Here are 2 things to watch for…

1. The trend lines get steeper (almost like a straight line)

2. The range of the candles get larger

If #1 and #2 occurs, then the market is likely to be in a parabolic move.

And in such cases, you want to trail your stop loss on the current market swing and exit the trade if the price closes below it.

Here’s an example…

Genius Brands 1-Hour Timeframe:

Next…

How to use Trend Line and identify trend reversal

Has this ever happen to you?

You see, the price break above the downward Trend Line and you think to yourself…

“The market is about to reverse higher because the Trend Line is broken.”

The next thing you know, the market heads lower, and the downtrend resumes itself.

Wtf, what’s going on?

Well here’s the deal:

Just because a Trend Line breaks doesn’t mean the trend is over.

Recall:

You’ve learned that a Trend Line needs regular “adjustment” as the market tends to have such a false breakdown.

So the question is…

How do you identify a trend reversal (to the upside)?

Well, here’s a 3-step technique you can use…

1. Wait for the price to break above the Trend Line

2. Wait for a higher low to form (this tells you the sellers have exhausted themselves)

3. If the price breaks the swing high, the market is likely to reverse higher (the buyers are now in control)

Here’s an example…

Netflix Daily Timeframe:

Now if you want to learn more, go read this post… How to Identify Trend Reversals without any Indicators

Conclusion

So here’s what you’ve learned:

- When you draw a Trend Line: 1) Focus on the major swing points 2) Connect the major swing points 3) Adjust the Trend Line and get as many touches as possible

- The steepness of a Trend Line gives you clues about the market condition so you can adjust your trading strategy accordingly

- The Trend Line Breakout technique helps you time your entry in a trending market

- You can use a Trend Line to trail your stop loss and ride massive trends

- If a Trend Line breaks, wait for the re-test and see if it holds. If it does, the market is likely to reverse in the opposite direction.

Now over to you…

How do you use Trend Line in your trading?

Leave a comment below and share your thoughts with me.

This knowledge is just priceless

We’re glad you are able to benefit from the article!

Excellent 👍

THank you Nirup!

I think, you won’t be forget by many traders. You helped me a lot so thank you so much R🔥🔥🔥🌟

Thank you for the kind words Rafal, we’ll definitely try to help you more in the future. Stay tuned!

Very Profound 😊

Definitely!

Well understood sir Rayner. Please I want to focus on one currency pair which is XAU/USD. What is the best strategy and timeframe that suits this pair for me to be consistently profitable?

Hey there Victor, there’s so much more important than strategy and timeframe when it comes to consistent profitability.

The key to consistent profitability is to look for a strategy and a timeframe you can be consistent with!

I always use my trend line as a signal to determine where the market is heading, if the market was on an uptrend, then a see a few bearish candles, I set my trend line, if it breaks below I sell, if it pulls back I buy😉

Thanks for sharing Sibongiseni!

Amazing stuff

Definitely!

You are a good teacher Sir, I’ve learned a lot from your YouTube videos..

Thank you, great to hear that Thatayame!

I would like to communicate with you

Of course, feel free to reach out to me at support@shootingstocks.com 🙂

Wonderful

Thank you Devendra!

Thanks 🙏 😇 For sharing your experience knowledge with us

You’re welcome, Jigar!

Thanks 👍. Details r interesting

You’re ewlcome, Ram!

Amazing. You truly broke things down

Great to hear that, Okolai!

This was really helpful. Thank you 😄

You’re welcome, Rambo!

You are such a great teacher you won’t be forgotten by many traders world wide keep it up bro🔥🔥 I hail from Nigeria

Thank you for the kind words!

I’m a intraday trader..i use 15,5 min time frame for trading…i actually trade supply demand and chart pattern as well as trendlines.

Awesome!

Does it work pretty well on your end trading such low timeframes while applying trend lines?

Wonderful

Great to hear that, Surya!

This is tremendous! I have learned more about trendline strategies.

Thank you for your kind words, Larry!

Wow! The article provides a concise overview of trend line trading and its relevance in the stock market. It offers valuable insights into using trend lines as a tool for identifying potential price reversals and making informed trading decisions. A helpful read for those interested in technical analysis.

Thank you for the kind words, Ben!

Glad this article is of help to you!

I love your technic strategy but I can’t discipline my self, until now Im loosing much more money

Keep on going Allan, lower your capital by withdrawing to the point that it’s within your comfort level, and then keep on pushing on!

The staff is a life changing lesson, I need more of the same things.

Definitely more to come, James!