This post is written by Jet Toyco, a trader and trading coach.

The book Trading in The Zone by Mark Douglas is possibly the most influential book in the trading industry — and for a great reason.

That’s why in this guide…

I won’t just slap in some quotes and tell you what they mean.

You will learn eight essential and practical trading tips and strategies that have helped me in my trading journey from the most impactful quotes found in Trading in The Zone by Mark Douglas.

Make sure to grab your pen and paper because this one’s going to be juicy.

Ready?

Then let’s get started…

1. “Market analysis is not the path to consistent results, and it will not solve the trading problems created by lack of confidence, lack of discipline, or improper focus.”

I hate to be the one to say it, but…

If you depend on other people’s market analysis to enter or hold a position, then you’re bound to lose a lot of money.

Let me explain:

Most market analysis will tell you where the market could potentially go.

However, it will rarely teach or give you options for managing and exiting the trade.

So by the time you blindly follow someone’s analysis and enter a trade, you’ll be left with a question:

“When do I exit the trade?”

“Should I hold this trade for a year?”

Yikes.

To make matters worse, instead of asking yourself when to cut your losses when the trade starts losing…

You start collecting more market analysis or opinions that only support your losing trade, which in turn converts you into an “investor.”

Sounds familiar?

So, what’s the solution?

How can you use market analysis to help you make objective trading decisions?

Know your trading method first

How you want to trade the markets should dictate how you want to analyze it, period.

If you want to be a swing trader…

Then you want to analyze markets that are currently at an area of value to buy low and sell high.

If you want to be a trend follower…

Then you want to analyze and look for trending markets and avoid ranging ones so that you can buy high and sell higher.

You see, consistency is vital in trading.

If your identity as a trader is inconsistent, then you can be damn sure your market analysis and results would be inconsistent as well.

Makes sense?

2. “Successful traders virtually eliminated the effects of fear and recklessness from their trading.”

It’s so easy to tell other traders:

“Trade without fear!”

“Trade without emotions!”

“Trade like a sniper and not like a machine gunner!”

However, even if you tattoo them in your arm or hear them in your dreams…

You’ll always find yourself breaking them if you don’t have proper trading routines to follow.

So, how exactly can you eliminate the effects of fear and recklessness?

Build a repeatable trading routine and schedule

Your trading routine & schedule will undoubtedly be different from mine because of several factors such as:

- Markets traded

- Time zone

- Responsibilities

But the main idea is to know when to and when NOT to check your charts exactly.

Because bad trading habits arise the more you stare at your trading account’s profit & loss.

You heard me right!

It’s a myth that “you need a lot of time to monitor the charts” to make money in the markets.

In fact, it’s the opposite!

Nonetheless, here’s an example of a trading routine if you are an intraday trader…

7:30 PM – 8:00 PM = Look for trading opportunities and start building your watchlist

8:00 PM – 11:00 PM = Execute your trades free of distraction as the market opens

11:00 PM – 11:30 PM = Journal and review your trades and call it a day

And another one if you are a full-time employee who trades part-time…

8:00 AM-8:30 AM = Look for trading opportunities and place limit/stop orders

12:30 AM to 1:00 PM = Check your portfolio and see if you’ve executed trades properly

6:00 PM to 6:30 PM = Journal and review your trades

3. “Learning more and more about the markets only to avoid pain will compound his problems because the more he learns, the more he will naturally expect from the markets, making it all the more painful when the markets don’t do their part.”

There are many traps and pitfalls in trading.

One of them is forcing your expectations in the market.

Here’s the thing…

Your results are a by-product of your process.

That’s why you must detach yourself from the results and attach yourself to the process that will consistently push you to reach further than your expected results.

Now, what exactly should be the process when it comes to taking trades?

Well, it usually comes in three phases.

So I’ll show you what they are exactly and what you should do when you are in that particular phase…

Phase 1: Before the trade

- Perform market analysis and due diligence

- Determine entries

- Determine the take profit price

- Determine the stop loss price

- Determine how many shares to buy (apply risk management)

Phase 2: During the trade

- Place entry and stop orders

- Focus on looking for other trading opportunities

- Don’t stare at the trade when you feel bored

- Don’t remove/widen your stop loss and look for other’s opinions to hold into a loss

Phase 3: After the trade

- Screenshot the chart for your trading journal

- Review your thought process and execution

- Repeat phase 1

In the end, you must let your rules do the talking and not take other people’s opinions into account when the trade is running!

4. “Fear makes it very difficult, if not impossible, to open ourselves in a way that allows us to learn something new.”

Most professional & profitable traders that I’ve met so far are enthusiastic students of the markets.

- They keep on learning new things.

- They’re not afraid to try something new.

- They’re more concerned about their growth than their profits.

New and arrogant traders, however?

- They are too focused on the rewards.

- They think their strategy is the holy grail and the rest are crap.

- They are too focused on their trade and justify losses.

Of course, that used to be me.

But we all grow at some point.

Now, how can you reduce or eliminate fears in trading almost instantly?

Start small and increase your trading capital gradually

For example, you have $10,000 to trade.

Having $10,000 to trade doesn’t mean you have a $10,000 mindset as a trader.

So if you’re experiencing fears with that account balance, reduce it to $2,000, then add another $2,000 every month as you prove yourself consistent with your execution and risk management.

After five months…

Not only do you get to deploy your capital fully, but you’ll get to be a fearless, consistent, and competent trader who’s learned a lot of lessons along the way.

Once you apply it, you’ll be looking forward to building your trading business instead of finding the right time to withdraw money from it.

In the end, the moment you open yourself to “possibilities,” instead of being too “enclosed” on what you have…

The trading world will be your oyster!

I believe this is one of the concepts that is consistently highlighted in Mark Douglas’ Trading in The Zone.

5. “Only the best traders cut their losses without reservation or hesitation when the market tells them the trade isn’t working.”

This one’s a golden quote from Trading in The Zone by Mark Douglas.

Here’s the reality…

No matter how long you trade, there will always be this pain of cutting losses.

However, it would be best never to forget why you placed it initially—limiting losses and exactly knowing when you’re wrong.

Now, if you already know the benefits of applying risk management…

How do you cut losses without hesitation?

You don’t!

Given that you…

Take advantage of automatic stop loss orders

Having an automatic stop loss order allows you to make objective decisions without being there to make the decision.

That’s right.

You’re the boss of your trading portfolio, and your trading platform is your employee to decide for you in advance!

Isn’t that great?

I know, I know.

Since we’re still on the topic of losses here, talking about it isn’t “great.”

But how would you feel if the market went against you even more, but you’re not there to take the hit since you cut your losses early?

You’d feel relieved, right?

So if you want to learn how to set stop loss orders, then I highly suggest this article here: The Definitive Guide on How to Set a Stop Loss

Sounds great?

6. “We have to be careful about what we project out into the future because nothing else has the potential to create more unhappiness and emotional misery than an unfulfilled expectation.”

I get it.

You want to make money in the markets.

You want to quit your full-time job and be your boss.

You want to save enough money so that you can go back to your family in another country.

You dream big.

Now, I’m not here to invalidate them because they are certainly possible!

However, things start to get more complicated when you underestimate the work it takes to achieve your dreams.

Let me explain.

A lot of traders don’t see trading as a long-term journey.

Instead, they think of it as a short-term one when they think that all that matters is strategy. Some of them are simply thinking of copying Mark Douglas’ trading strategy, thinking it’ll make them rich too.

By the time they realize the “gap” of what it takes to reach their goals…

They start buying courses, “secret strategies,” and trading robots to attempt to shortcut their way to reach their goals.

But the truth is that trying to look for that shortcut will only set your progress back even more and to be discouraged.

Now, what’s the solution?

What should you do?

Let me tell you…

Start with small goals

While dreaming big or having big goals is essential…

Never lose sight of having small goals because they are what take you towards the finish line.

So, instead of having only one goal of becoming a full-time trader, determine what it takes to get there!

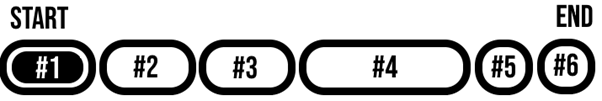

The way you design your goals will undoubtedly be different from mine, but here’s an example…

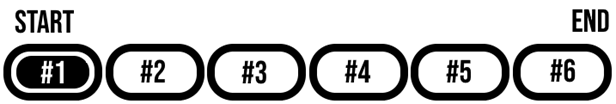

Goal #1: Open a broker account

Goal #2: Develop a trading plan

Goal #3: Start trading live with a small account

Goal #3: Optimize and improve the trading strategy by reviewing the trading journal

Goal #4: Deposit more funds every month for the next year

Goal #5: Open a new trading portfolio and build a 6-month emergency fund

Goal #6: Go full-time trading with two other sources of part-time income

Can you see how important this is?

By having small goals, you get to become a progressionist rather than be a perfectionist.

Of course, some goals may take months or years compared to others…

But that doesn’t matter.

Because what matters is that you’re inching closer towards your goals.

By the time you immerse yourself in the process…

Many possibilities and creativities open up, and you’ll realize that you’ll have bigger goals than the one you initially had.

Pretty enlightening, am I right?

7. “Each individual will define, interpret, and consequently experience whatever information he is exposed to in his unique way.”

Here’s one of the best things I’ve learned from Mark Douglas’ Trading in The Zone:

There are so many ways to profit from the markets and never just one.

Also, you and I can be two very different traders and can still be profitable.

Now, why am I telling you this?

Let me tell you…

Along your trading journey, you will encounter a lot of trading groups and communities out there.

Some trading communities will hamper your growth due to toxicity.

While some trading communities will boost your growth as each member attempts to learn from each other’s differences.

That’s why it’s crucial for you to…

Choose a trading community that teaches you things beyond strategies and respects your opinions

You cannot control what other people think of you or how they react to your opinions.

However, you can control what your environment should be.

You’re probably wondering:

“Okay, so how do I know if a trading community is good?”

Here are a couple of things.

1. They show their losses as well and not only their gains

Most traders show their gains to feel good about themselves but never actually contribute their journey on what it took to achieve those gains.

Additionally, only showing profits and not losses as well gives you an illusion that trading is easy.

The truth is that it’s not!

So if you’re in a trading community that shares their thought-process on how they handle losses or what it took to achieve their gains…

That’s the sign you’re home.

2. They don’t hype a specific market

Here’s a little bit of a story…

I was in a group wherein a particular admin was exciting its members to buy a specific stock.

After a few weeks, the stock made a breakout!

Everyone was happy!

However, the admin was sure that it could still go up in price in years to come, so he advised everyone to hold.

Until…

The stock made a false breakout along with a considerable decline…

It doesn’t end there!

The admin was showing his losses and kept telling everybody:

“Keep holding my dear friends, I’m with you!”

“The company has good earnings and a lot of projects, it will go up!”

At that point, I’m not sure what happened to the members who followed the admin’s advice because I had already left the group.

But looking back, the stock continues to decline even further.

So, why am I sharing this?

Well, it’s because even though many people lost money believing in the admin’s delusions…

It’s not the admin’s fault that those people lost money.

They are the one that hits the buy button, so the responsibility was theirs!

So the moment you join a group and encounter a similar scenario wherein someone in authority hypes a particular market with a “guarantee” mindset and removes opinions against it…

Stay away and leave the group immediately!

8. “Adding random variables makes it extremely difficult, if not impossible, to determine what works and what doesn’t.”

Here’s the truth:

Adding more indicators on your chart doesn’t mean that the trade is guaranteed to be a winner.

It just adds more noise and possibly keeps you from making trading decisions.

But wait, there’s more!

The more indicators or random trading rules you add into your plan…

The harder it is to pinpoint which one of them works and what doesn’t.

Again, what’s the solution?

Well, it’s a solution that’s hard to stomach, but you must choose ONE indicator for:

- Trend filter

- Entries

- Stop loss

- Take profit

Let me give you an example…

One indicator for trend filter

As you know, you can both long and short the markets.

To know which direction you should trade, you can consider using the 200-period moving average:

If the price is above the 200 MA = You look for long setups

If the price is below the 200 MA = You look for short setups

Simple, am I right?

Next…

One indicator for entries

For this example, I would be using the 14-period Relative Strength Index indicator.

To put it simply…

Wait for the price to close below RSI 50, then enter when the price closes above RSI 50:

That’s it, a simple and objective way to enter a trade!

One indicator for stop loss

At this point, I’m sure you already know how important having a stop loss is.

Now the question is, which indicator can identify where your stop loss would be objective?

In this case, I suggest using the Average True Range indicator then multiply its value by three (3 ATR) as a buffer.

How to use it, you may ask?

Just subtract your entry price from the ATR value:

Last but not least…

One indicator for taking profit

Unfortunately, how you take profits will depend on your trading method, so there could be many answers.

But if you are a trend follower, for example.

Then you can use the 20-period moving average.

Meaning, you will not sell your position until it closes below 20 MA:

That’s it!

Now I want you to promise me that you’ll backtest this strategy first before trading this live.

Nonetheless…

Can you see how these indicators complement and do not contradict each other?

You see, technical indicators are not magical lines on your chart that bring in profits.

They are tools, and how you use those tools makes them truly effective and efficient!

So, once you already have a set of objective rules in place, the next thing you want to do is to…

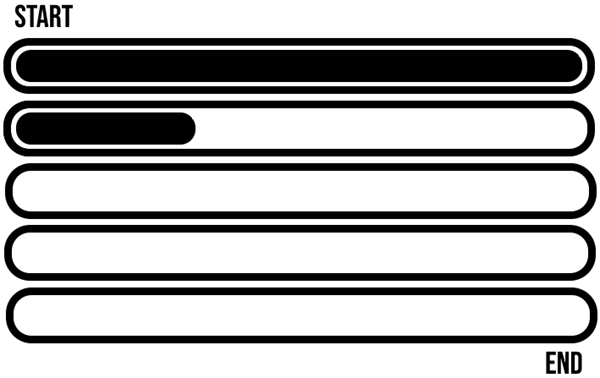

Execute your rules for 20-30 trades regardless of the result and find patterns on how you can improve them.

The reason why you’d want to use one indicator per category is for this exact reason:

To make it possible to know what works and what doesn’t.

Can you see how it’s all coming together?

Of course, it’s not easy to execute 20-30 trades flawlessly.

That’s why if you find that you’ve broken your trading rules, more than 50% of those trades…

It means that the only thing you should be improving is your trading routine and not your trading strategy.

On the other hand…

If you have consistently executed 20-30 trades without breaking your rules (mostly), then you now need to review your past trades and ask:

- Could you have prevented losing trades if you had used a 100-period moving average trend filter instead?

- Could your entry price be better if your RSI period is 7 instead of 14?

- Could you have reduced losses or stayed in the trade longer if you had a wider stop loss by using 6 ATR instead of 3 ATR?

- Could you have taken more profits if your trailing stop loss was an 8-period moving average instead of a 20-period moving average?

At this point, I don’t know since only your results will be able to answer those questions!

But this is what it means to find your “edge” in the market.

Not my edge.

Not other’s edge.

But YOUR edge in the market.

Whew, that’s a lot of lessons!

Applying them is no easy task, so feel free to get back to this guide from time to time.

But for now…

Let’s do a quick recap of what you’ve learned today.

Conclusion

Mark Douglas’ Trading in The Zone is truly a phenomenal book for traders to invest their time and money.

Despite the lessons I’ve shared with you today, it’s only about 30% of what the book has to offer you.

But as someone who has read Mark Douglas’ Trading in The Zone three times over, it boils down to these things:

- Remove your expectations in the market and be focused on the process instead

- Always learn how to manage your risk

- Aim to be consistent in all aspects of trading (i.e., trading routine and execution)

- Focus on what you can control (process & risk) and not on the things you can’t (the markets)

- Be creative and be open-minded to other concepts and possibilities

- Focus inwards on what you want and not try to imitate others

With that said…

Here’s what I’d like to know:

Have you already read Mark Douglas’ Trading in The Zone?

What else have you learned from the book?

Let me know in the comments below!

Hi Mr Jet,

Greetings from UAE

As always your advices and guidance are so helpful for a novice like me, is this book also.

100% agree

In this book , Mr Mark is a great psychologist who has portrayed explicitly a typical novice traders trajectory in his book.

Even though I am not a reader by habit, somehow I have heard an audio of this book.

Amazing book.

Do you suggest any other trading books for a beginner like me

Thanks

Regards

Sunil

Hey there Sunil,

Great to have you benefit from this guide!

For beginners, I suggest you implement more than you spend more time reading, so you may check out the trading academy here: https://tradingwithrayner.com/academy