The Donchian Channel indicator is powerful.

It’s like a Moving Average — on steroids.

Once you’ve learned the secrets, you’ll hit me on the head and say…

“Why didn’t you tell me earlier!?”

Because good things come to those who wait.

So here’s what you’ll learn today:

- What is a Donchian Channel and how does it work

- A common mistake to avoid when trading the Donchian Channel

- How to use the Donchian Channel and capture every trend — guaranteed

- How to scale in your winners and reap massive profits

- How to filter for high probability trading setups

- Donchian Channel strategy: How to use it and ride enormous trends

- Average True Range and Donchian Channel combo: How to catch EXPLOSIVE breakout trades consistently and profitably

Or if you prefer, you can watch this training video below…

What is a Donchian Channel and how does it work

Richard Donchian developed the Donchian Channel indicator (the pioneer of Trend Following).

The Donchian Channel has 3 parts to it:

- Upper band – the 20-day high

- Middle band – the average of the Upper and Lower band

- Lower band – the 20-day low

Here’s how it looks like:

The Donchian Channel uses a default setting of 20-period, but you can adjust it to your preference (like 30-day, 50-day, etc.).

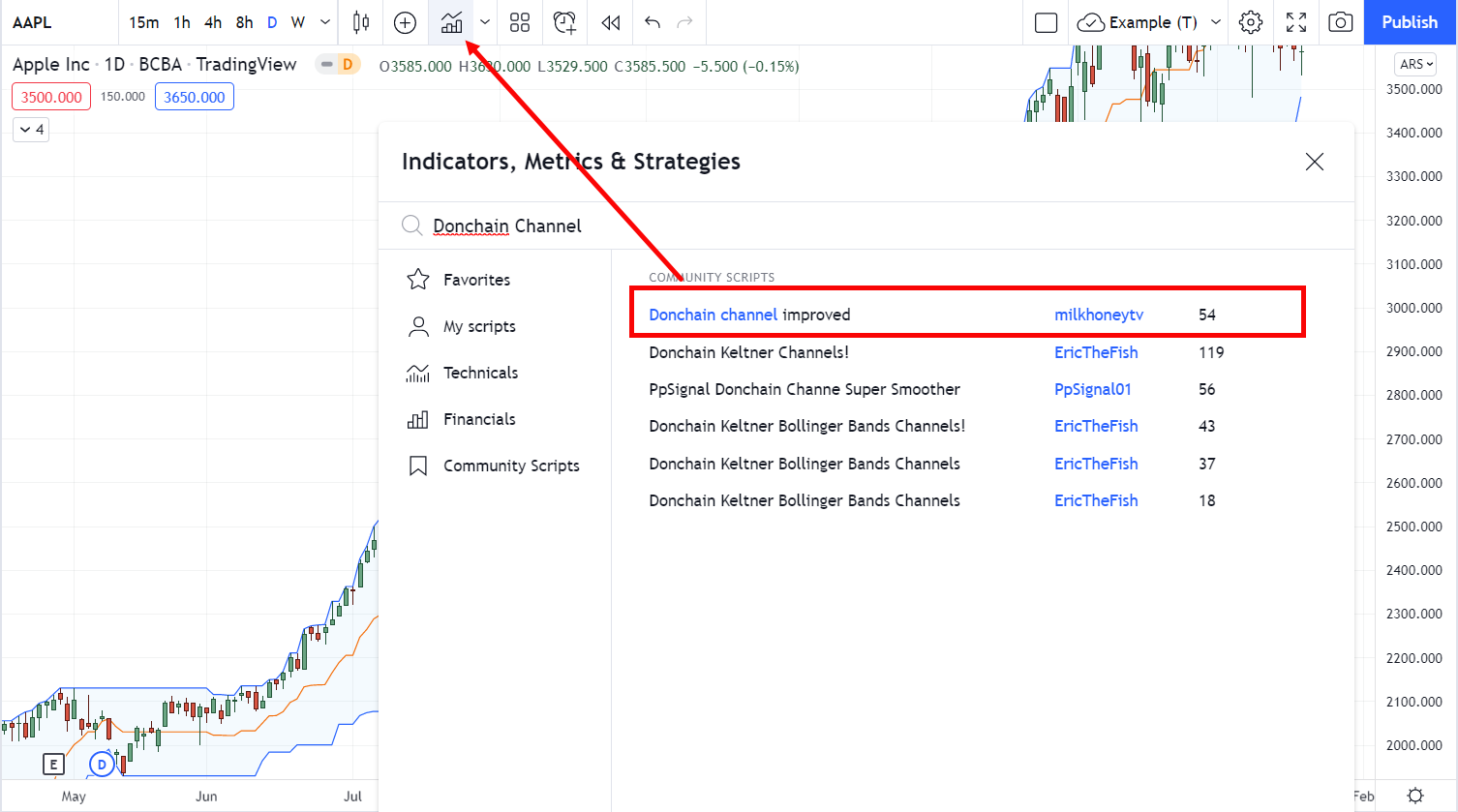

Quick Tip:

If you use TradingView, you can find it under the “Indicators” tab.

Don’t make this mistake when trading the Donchian Channel…

Here’s the thing:

Many traders make the mistake of “blindly” trading the bands.

They think if the price is at the upper band, it means the market is overbought and it’ll reverse lower.

So, they go short.

Big mistake!

Why?

Because in an uptrend, the price will hug the upper bands for a long time.

Here’s an example:

Ouch.

So the lesson is this…

Don’t use the Donchian Channel indicator to identify overbought/oversold market conditions.

Instead, it’s better to use it to time your entries & exits which I’ll share more in the next section…

Donchian Channel Breakout: How to “catch” every trend in the market — guaranteed

Here’s the thing:

Most traders want to ride BIG trends.

And the strategy they use is:

- Wait for a pullback

- Wait for a better price

- Wait for the market to come to them

Is there a problem with this?

YES.

Because the market might not form a pullback — and you’ll miss the entire move.

So what’s the solution?

You must trade breakouts.

Think about it:

For a market to trend, it must break out higher.

So if you trade breakouts, you’ll catch every trend.

Does it make sense?

Great!

Here’s how you can do it…

If the price “touches” the upper band of the Donchian Channel, you go long.

An example:

Now if you can do this consistently, you’ll catch every trend in the market — guaranteed.

Pro Tip:

You can adjust the Donchian Channel and trade the 50-day, 100-day or even 200-day breakout.

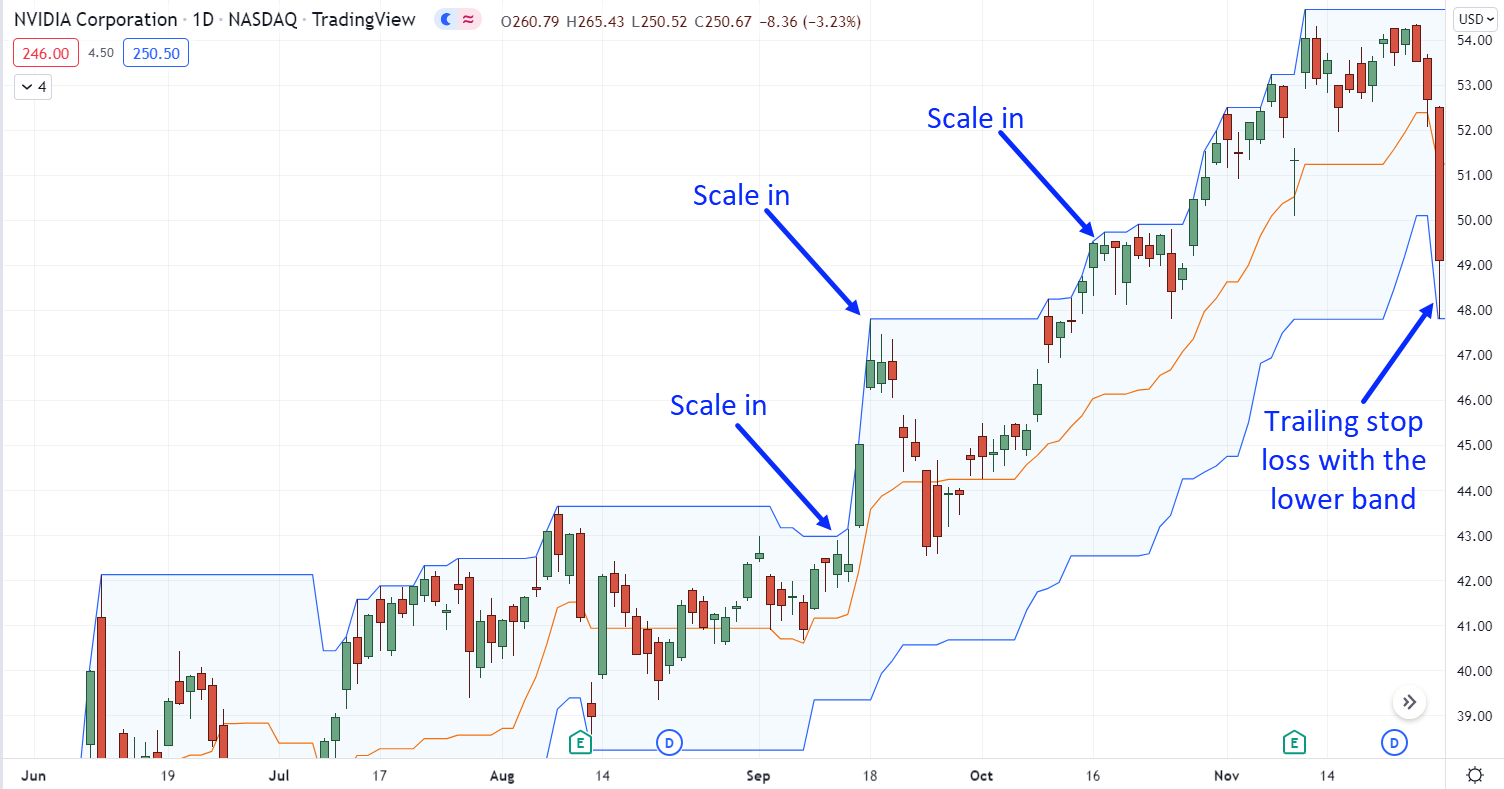

How to use the Donchian Channel to scale in your winners and reap massive profits

So, you’ve entered a trade and market moves in your favor.

Now what?

Well, you can scale in your trades.

This means you’ll add on to your winners so you can make even more profits.

Here’s how…

1. Have open profits of at least 2R

Because if the market goes against you, you have a “buffer” to withstand the pullback.

If you have no open profits and you scale in your trade, you might lose more than intended.

2. Scale in your winners with reduced risk

Next, you can use the Donchian Channel breakout as an entry trigger.

Now, you don’t want to risk 1R on your later trades because you could lose all your open profits (when the market does a pullback).

Instead, scale in with 0.5R (or less), this lets you better withstand the pullback and still earn a larger profit if the market moves in your favor.

3. Determine your exit

Lastly, you must know where to exit your positions.

Will you exit all at once or treat each position as a new trade?

In my experience, it’s easier to exit all positions when your trailing stop is hit and then “restart” all over again.

Here’s an example:

Donchian Channel: How to use it and filter for high probability trades

Recall:

The middle band of the Donchian Channel is the average price of the Upper and Lower band.

This means you can use it as a trend filter to know whether you should be buying or selling.

Here’s how:

- Adjust the Donchian Channel to 200-period (to define the long-term trend)

- If the price is above the middle band, you look for buying opportunities

- If the price is below the middle band, you look for selling opportunities

Here’s an example…

Pro Tip:

If you trade stocks, apply the trend filter to the stock index.

For example: if you want to buy US stocks, check if the S&P 500 is above the 200-day Moving before you go long.

Donchian Channel strategy: How to use it and ride enormous trends

Here’s a fact:

To ride a massive trend in the markets, the kind that makes other traders go green with envy, then you must…

Trail your stop loss.

This means…

No target profits.

No second-guessing yourself.

No bailing out even when it feels “uncomfortable”.

You honor your trailing stop loss and get out when the signal tells you to.

Can you do it?

So, here’s how you can use the Donchian Channel to ride big trends:

- If you want to ride an uptrend, use the lower band (20-day low) to trail your stop loss

- If you want to ride a downtrend, use the upper band (20-day high) to trail your stop loss

Here’s an example:

Pro Tip:

To ride shorter or longer-term trends, simply adjust the settings on the Donchian Channel.

A higher value will ride a long-term trend and a lower value will ride the short-term trend.

Average True Range and Donchian Channel Combo: How to catch EXPLOSIVE breakout trades consistently and profitably

So how do you know when the market is about to have an EXPLOSIVE breakout — before it occurs?

Step 1:

You use the Average True Range indicator (ATR) and identify multi-year low levels on the ATR indicator.

Ideally, you want it to be as low (or even lower) than the previous multi-year low.

Here’s an example:

Step 2:

You trade the breakout of the Donchian Channel.

If the price breaks above the upper band (20-week high), you go long.

If the price breaks below the lower band (20-week low), you go short.

Here are a few examples…

Now…

The idea behind it is the market moves from a period of low volatility to high volatility.

So the ATR indicator helps you identify periods of low volatility and the Donchian Channel lets you trade the breakout to capture the move.

This is powerful stuff, right?

Frequently asked questions

#1: In the Donchian Channel Breakout, I don’t see the price breaking out of the channel, it only touches the top or bottom channels and then the Donchian Channel adjusts to the price change. Can you explain where the breakout is?

Let’s say the blue upper line of the Donchian Channel is plotting the 200-day high of the market. So if the price touches it, this means the price has broken out of the 200-day high.

Conversely, if the price has touched the blue lower line, this means the price has broken down from the 200-day low.

#2: What’s the difference between the Bollinger Bands and the Donchian Channel?

Bollinger Bands take into account the volatility of the markets and it adjusts accordingly. If you want to discover more about Bollinger Bands, you can read my blog post here.

Whereas, the Donchian Channel is fixed based on a period’s highs or lows. If you’re using a 200-period Donchian Channel, then it plots the highs and lows of the last 200 periods.

#3: Could you explain what ‘R’ stands for?

‘R’ simply tracks your returns relative to the risk that you’re taking. For instance, if you risked $10 and you earn $50, you’ve gained 5R.

Conclusion

So here’s what you’ve learned:

- The Donchian Channel is a Trend Following indicator

- You can long breakouts when the price breaks above the upper band

- If the price is above the middle band, have a long bias so you can trade with the trend

- You can ride a trend by trailing your stop loss on the outer bands

- The ATR and Donchian Channel combo helps you catch explosive breakout trades before everyone else

Now here’s a question for you…

How do you use the Donchian Channel indicator?

Leave a comment below and share your thoughts with me.

Sir will donchain works in day trading. How to use it

Hey there Raghu, this post may help you out: https://www.tradingwithrayner.com/donchian-channel/

I hadn’t used it…But I’m going to try it out…Sounds like something I can definitely add to my arsenal…

Thanks always “My Friend”

You’ve be very helpful…

It’s definitely a versatile tool, you’re welcome, My friend!

I use the Donchian channel in my forex trading algorithm with great success.

I’ve backtested and researched 100s of indicators and can’t imagine trading without this one!

Wow, amazing to hear that Randall, this indicator sure is simple, yet effective!

Haven’t understood the scale in procedure and the meaning

In you reply to a question about Donchian Channel vs Bolinger Bands you mention a blog link that Couldn’t find. So I searched through the blog and couldn’t see a post regarding BBs. Can you help direct me please.

Hey there Ian, check this out!

https://www.tradingwithrayner.com/bollinger-bands-trading-strategy/

Wen the price touch the upper band u go buy,and get out wen the price touch the lower band

Thanks for sharing!

Can we use this indicator in currency pairs??

Indeed you can!