Does the market always seem to move lower after you hit the buy button?

Do you wish your trade will be over soon because you HATE to watch your P&L swing up and down?

Are you frustrated to see the market ALMOST reached your target profit, but only to do a 180-degree reversal and hit your stop loss?

If you replied YES to any of the above, then I’ve got the answer for you.

Swing trading.

Now you might be wondering:

“What is swing trading and how does it work?

Don’t worry.

Because in this post, you’ll learn everything you need to know about swing trading — including 3 swing trading strategies that work.

Sounds good?

Then let’s begin…

Swing Trading Basics: What is swing trading and how does it work

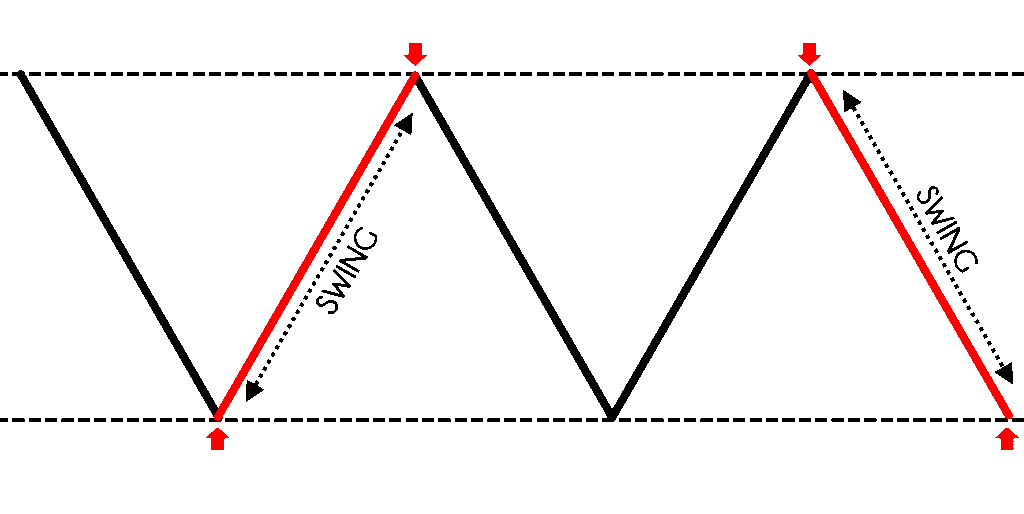

Swing trading is a trading methodology that seeks to capture a swing (or “one move”).

The idea is to endure as “little pain” as possible by exiting your trades before the opposing pressure comes in.

This means you’ll book your profits before the market reverse and wipe out your gains.

Here’s an example:

Next, here are the pros & cons of swing trading…

Pros:

- You need not spend hours in front of your monitor because your trades last for days or even weeks

- It’s suitable for those with a full-time job

- Less stress compared to day trading

Cons:

- You won’t be able to ride trends

- You have overnight risk

So far so good?

Then let’s move on…

Swing trading strategies #1: Stuck in a box

And one thing…

The swing trading strategies I’m about to share with you have “interesting” names attached to it.

This helps you understand the trading setup better so you know how to apply it to your trading.

Now, let me introduce to you the first swing trading strategy for today…

Stuck in a box.

It’s swing trading in a range market because the market is “stuck” between Support and Resistance (somewhat like a box).

Here’s how it works:

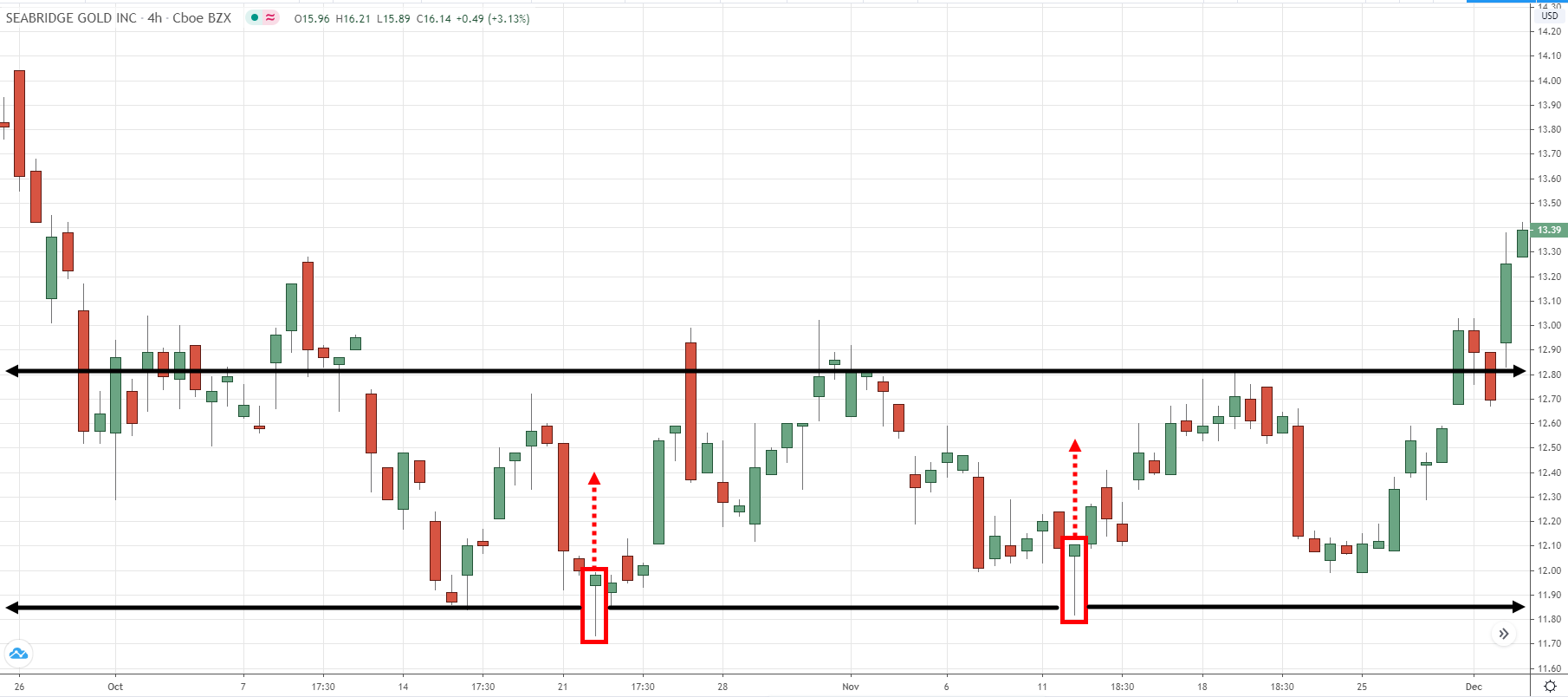

1. Identify a range market

2. Wait for the price to break below Support

3. If the price breaks below Support, then wait for a strong price rejection(a close above Support)

4. If there’s a strong price rejection, then go long on the next candle open

5. Set your stop loss 1 ATR below the candle low and take profits before Resistance

Here’s an example…

Seabridge 4-Hour Timeframe:

Now you might be wondering:

“Why should I take profits before Resistance?”

Recall…

As a swing trader, you’re only looking for “one move” in the market.

So to ensure a high probability of success, you want to exit your trades before the selling pressure steps in (which is at Resistance).

Make sense?

Good because we’ll be applying this concept to the remaining swing trading strategies.

Next…

Swing trading strategies #2: Catch the wave

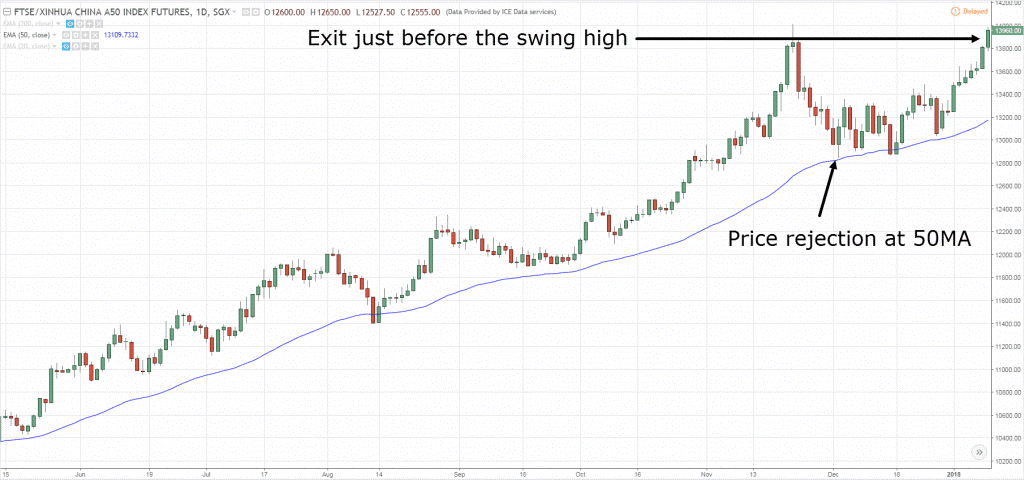

This swing trading strategy focuses on catching “one move” in a trending market (like a surfer trying to catch the wave).

The idea here is to enter after the pullback has ended when the trend is likely to continue.

However…

This doesn’t work for all types of trends.

Instead, you want to trade trends that have a deeper pullback because there’s more “meat” towards the upside.

As a guideline, you want to see a pullback at least towards the 50-period moving average (MA) or deeper.

Now, let’s learn how to catch the wave with this swing trading strategy…

1. Identify a trend that respects the 50MA

2. If the market approaches the moving average, then wait for a bullish price rejection

3. If there’s a bullish price rejection, then go long on next candle

4. Set your stop loss 1 ATRbelow the low and take profits just before the swing high

Here’s an example…

A50 Daily Timeframe:

Do you want more examples?

Then go watch this training video where I’ll show you how to identify more swing trading setups step by step…

Now you might be wondering:

“But why the 50-period moving average?”

I go with the 50MA because it’s watched by traders around the world so that could lead to a self-fulfilling prophecy.

And usually, the 50MA coincides with previous Resistance turned Support which makes it more significant.

Now, it doesn’t mean you can’t use 55, 67, 89, or whatever moving average you choose because the concept is what matters.

Swing trading strategies #3: Fade the move

Now you’re probably thinking:

“What’s the meaning of fade?”

It means… to go against.

Basically, you’re trading against the momentum (also known as counter-trend).

So, if you’re the trader that likes to “go against the crowd”, then this trading strategy is for you.

Here’s how it works…

1. Identify a strong momentum move into Resistance that takes out the previous high

2. Look for a strong price rejection as the candle forms a strong bearish close

3. Go short on the next candle and set your stop loss 1 ATR above the highs

4. Take profits before the nearest swing low

Here’s an example…

DHT Daily Timeframe:

Do you want more examples?

Then go check out this training video below for more detailed examples…

Now…

You’ve learned 3 types of swing trading strategies that work.

But there’s one important thing that’s not covered…

Your trade management.

For example:

What if you enter a trade and the market didn’t hit your stop loss?

But neither has it reach your target profit.

So what should you do?

Do you hold the trade?

Do you exit the trade?

Or do you pray?

Well, I’ll cover all these and more in the next section…

How to manage your trades so you can trade with confidence and conviction

Now, with trade management, there are 2 ways you can go about it…

- Passive trade management

- Active management

I’ll explain…

1. Passive trade management

For this method, you’ll either let the market either hit your stop loss or target profit — anything between, you’ll do nothing.

Ideally, you want to set your stop loss away from the “noise” of the markets and have a target profit within a reasonable reach (before key market structure).

Here are the pros & cons of it…

Pros:

- Trading is more relaxed as your decisions become more “automated”

Cons:

- You can’t exit your trade ahead of time even though the market is showing signs of reversal

- Possible to see a winning trade become a full 1R loss

2. Active management

For this, you’ll watch how the market reacts and then decide whether you want to hold or exit the trade.

Now, this is important…

For an active approach to work, you must manage your trades on your entry timeframe (or higher).

Don’t make the mistake of managing it on a lower timeframe because you’ll scare yourself out of a trade on every pullback that occurs.

Here are the pros & cons of it…

Pros:

- You can minimize your losses instead of getting a full 1R loss

Cons:

- More stressful

- You may exit your trade too soon without giving it enough room to run

If active trade management is for you, then here are two techniques you can consider:

- Moving average

- Previous bar high/low

Let me explain…

Moving Average

This technique involves using a moving average indicator to trail your stops.

You’ll hold on to the trade if the price doesn’t break beyond the moving average.

If it does, then you’ll exit the trade.

An example…

Gilead Daily Timeframe:

This technique is useful for swing trading strategies like Catch the Wave because the moving average tends to act as a dynamic Support & Resistance in trending markets.

Next…

Previous bar high/low

This technique relies on the previous bar high/low to trail your stop loss.

This means if you’re short, then you’ll trail your stop loss using the previous bar high.

If the market breaks and closes above it, then you’ll exit the trade (and vice versa).

Here’s what I mean…

DHT Daily Timeframe:

This technique is useful for swing trading strategies like Fade the Move because the market can quickly reverse against you.

So, you don’t want to give your trade too much room to breathe and quickly cut your losses when the market show signs of reversal.

Frequently asked questions

#1: Which of the 3 trading strategies above is the best?

There’s no best trading strategy out there and it all depends on your trading style to see which approach resonates with you.

For example, if you’re a trend trader, then you’ll probably look for trend continuation setups using Strategy #2. If you’re more of a contrarian trader, then Strategy #3 might be more suitable for you to fade the move.

#2: How will I know if there’s a bullish or price rejection on the next candle?

You’ll have to wait for the candle to close first before placing a trade. If the candle closes strongly near the high of the range, then it’s a bullish price rejection. If the candle closes strongly near the low of the range, then it’s a bearish price rejection.

Conclusion

So here’s what you’ve learned:

- Swing trading is about capturing “one move” in the market by exiting your trades before the opposing pressure comes in

- Stuck in a Box is a swing trading strategy suited for range markets

- Catch the Waveis a swing trading strategy suited for trending markets

- Fade the Moveis a counter-trend swing trading strategy

- Passive trade management is less stressful but you must be comfortable watching winners turning into a full 1R loss

- Active trade management is more stressful but you get to minimize your losses

Now here’s my question for you…

Do you have any swing trading strategies to share?

Leave a comment below and let me know your thoughts on the different swing trading strategies.

Simply the best

Definitely!

Thanks 😊👍 so much big boss for this eye 👀 opening on your in your swing strategy method.thanks alot may God 🙏 bless you.😭😭.

You’re welcome Udoh!

You just make me know the type of trader I am now, thanks

Good to hear that, now focus on that specific style!

Good job sir, You said we’ve to wait for the candle to close before decision making , please the terms strongly close high of the range and low of the range

Hey there Ahmed!

Usually, we want to make sure that it’s a large-bodied candle and not an indecision candle before we enter the trade as the previous candle closes!

Thank you Sir… You just confirmed what I have been learning and MORE!

You’re welcome, Kester

Good to know that!

Hello,

Please What do you mean by candle closes strongly near the high of the range?

Can I see a picture or illustration

Thank you

Beautiful art of work ,Continue what you are doing sir you are empowering most of us in Africa

We’re happy to hear that, John!

Please Mr.Rayner can you kindly share some more light on (when the candle closes strongly near the lows and highs of the range) thank you