Let me ask you…

Have you ever bought a breakout because you think the price will move higher?

After all, the textbook says a breakout is “confirmed” when the price closes above Resistance.

So, you go long.

And the price moves in your favor (a little).

But the next thing you know…

The market does a 180-degree reversal and BOOM, you got stopped out — now you’re sitting in a sea of red.

Here’s what I mean…

Bull trap on Gilead Sciences (GILD) 4-Hour chart:

Now…

What I’ve just described to you is called a Bull Trap (and the opposite is called a Bear Trap).

The buyers are “trapped” as their trade went against them (and they are sitting in the red).

Now you’re probably wondering:

“So how do I avoid the Bull Trap?”

Well, that’s what you’ll discover next…

Read on…

How to Avoid the Bull Trap

Now here are 2 tips you can use to avoid getting caught in a Bull Trap:

1. Don’t “chase” parabolic breakouts

2. Trade breakouts with a build-up

Let me explain…

1. Don’t “chase” parabolic breakouts

I know.

You’re tempted “chase” a breakout.

After all, you’re thinking:

“The candles are so bullish. How can it possibly reverse?”

And that’s when shit is about to happen.

Why?

Because when the price has exploded higher, there’s no “floor” (like swing low or Support) to hold these higher prices.

This means the price can easily reverse in the opposite direction (until it finds the nearest “floor”).

Here’s what I mean…

The nearest floor on Beyond Meat (BYND) 1-Hour chart:

And also…

When you “chase” a breakout, there’s no logical place for you to set a stop loss so you’re likely to get stopped out, even on a pullback.

So the bottom line is this:

If you want to avoid a Bull Trap, stop “chasing” breakouts.

2. Trade Breakouts with a build-up

Now you’re probably wondering:

“Then how should I trade breakouts?”

The secret is this…

You want to trade breakouts with a build-up.

So what’s a build-up?

A build-up is a tight consolidation that you see on your charts.

It should be so tight that the candles have “no space” to move.

Here’s an example…

Buildup on Exxon Mobil (XOM) 4-Hour chart:

But why wait for buildup?

Here are 3 reasons why…

#1: Favourable risk to reward

You have a logical place to set your stop loss (below the low of the build-up), and this offers a more favorable risk to reward.

#2: A sign of strength

When the price forms a build-up at Resistance, it’s a sign of strength.

Because it tells you the buyers are willing to buy at higher prices (even in front of Resistance).

#3: Profit from losing traders

Imagine…

If the price is at Resistance, what would most traders do?

They’ll go short and have their stop loss above Resistance, right?

And the longer the price hovers at Resistance, the more traders will short and buy stop orders would cluster above Resistance.

But what happens if the price breaks above Resistance?

This cluster of buy stop orders gets triggered which fuel more buying pressure (and this increases the odds of a successful breakout).

This is powerful stuff, right?

Then let’s move on because I’ve got more to share…

The Bull Trap Pattern: How to profit from “trapped” traders

At this point…

You’ve learned how to avoid a Bull Trap and not get caught on the wrong side of the market.

Now, it’s time to trade the Bull Trap pattern and profit from “trapped” traders.

Here’s how it works in a ranging market…

1. Identify a strong power move coming into Resistance (the stronger it is, the better)

2.Let the price breaks above Resistance (to trap the breakout traders)

3.Look for a strong bearish close below Resistance (entry trigger)

Here are a few examples…

Bull trap set up on Walmart (WMT) 4-Hour chart:

Bull trap set up on JP Morgan (JPM) 4-Hour:

Bull trap set up on General Electric (GE) 4-Hour:

Alternatively…

You can also profit from “trapped” traders hoping to score a huge bullish reversal in an existing downtrend.

Here’s how it works:

1. Identify a deep retracement to previous Support (in a downtrend)

2. Let the price break above the Support turned Resistance (to trap the bullish reversal traders)

3. Look for a strong bearish close below the Support turned Resistance (entry trigger)

Here are a few examples…

Bull trap set up on Royal Caribbean Cruises (RCL) 4-Hour:

Bull trap set up on Johnson & Johnson (JNJ) 4-hour:

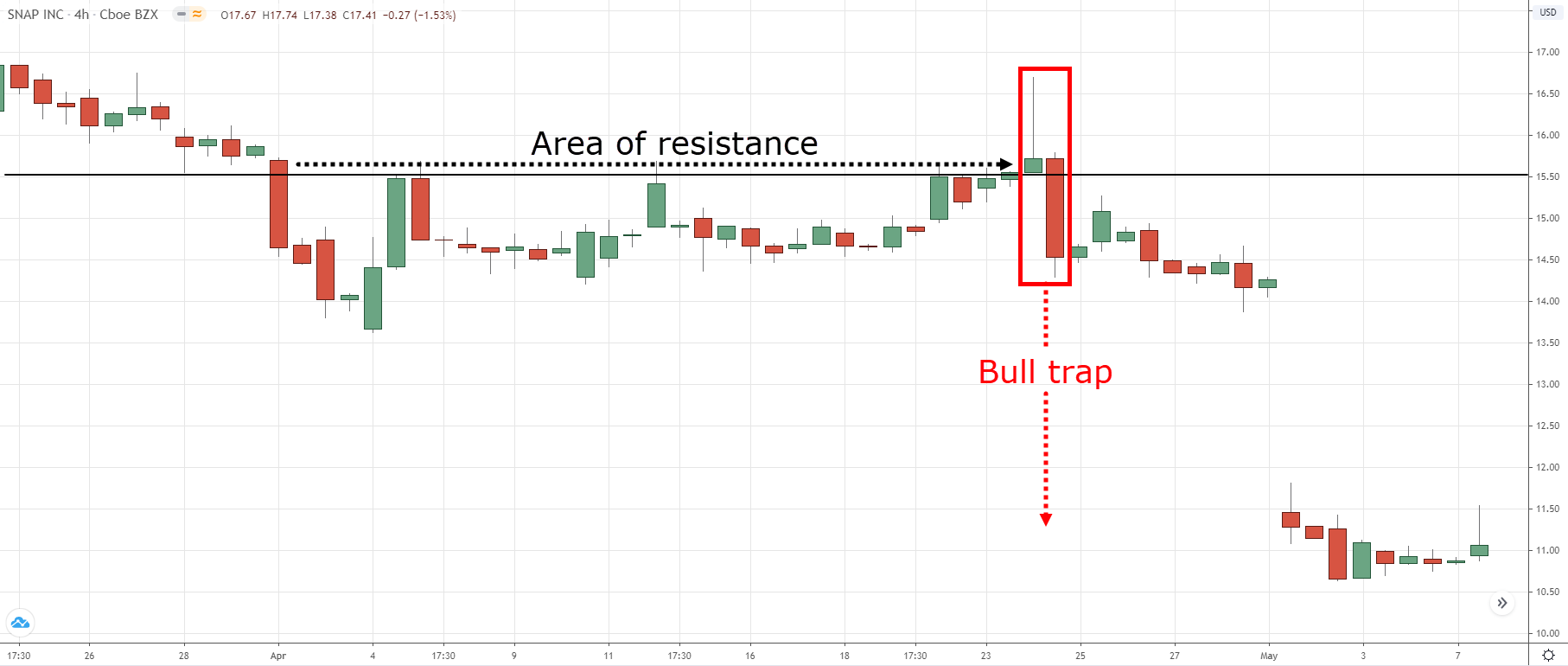

Bull trap set up on Snap Inc (SNAP) 4-Hour chart:

Next…

How to set your stop loss

Well, you can set your stop loss 1 ATR above Resistance.

This way, your trade has room to breathe and you avoid getting stopped out on a “sudden spike”.

Here’s what I mean:

If you want more details, go watch this training video below…

Moving on…

How do you exit your winning trades?

If you realized:

The Bull Trap pattern requires you to go short against strong momentum.

Now if you’re correct, the market could quickly reverse lower quickly (and poof, profits).

But if you’re wrong, the market could quickly move higher (and boom, stopped out).

So, how do you exit your winners?

Well, what I’d like to do is trail my stop loss on the previous candle high.

This way, I’ll ride the move lower if the price continues lower.

But if it shows signs of strength by closing above the previous candle high, I exit the trade.

Here’s what I mean…

Trailing stop loss on Johnson & Johnson 4-Hour chart:

Of course, this isn’t the only way to manage your trades.

You can also exit your trades at the nearest swing low, Support area, etc.

If you want to find out more, go watch this training video below…

Conclusion

So in today’s post, you’ve learned:

- A Bull Trap occurs when you buy a breakout only to have the price reverse lower

- 2 ways you can avoid a Bull Trap: 1) Stop “chasing” breakouts 2) Trade breakouts with a build-up

- A Bull Trap trading strategy to profit from “trapped” traders

Now here’s a question for you…

What do you think of the Bull Trap pattern?

Leave a comment below and share your thoughts with me.

Excellent. Great knowledge of Priceactionchart . Learnt so many techniques from your videos…

Awesome to hear that Vipin, keep on learning!

1. Clear bull trap explanation,

2. how to recognize it,

3. how to avoid it, and

4. sample strategies to play it.

Good article boss.

Very well put, thank you, Lakshmanan!

smarter every day, thanks rayner!

I’m glad that you’re able to benefit from this guide Zwp!

I have attended multiple no of courses conducted by Forex & ETF-Shares so called trading gurus but still comes out at the end of the day unsure & still dazed (as the training contents-materials so advocate are not specific or details, nor easy to understand , or objectives reasons , instructions are given & explain clearly ,direct to the point of execution ) no confident not competent to analyse a market ( market structure as in your training) to put on a trade . After i attended your Ultimate Price Action training modules & later the Ultimate Systematic Momentum Training Modules , i think for my ultimate search for my Ultimate gurus journeys ends here. ( This for the Off records -Gurus courses i have attended & conducted by Mario Singh , JT Low, Thomas the Coach, Dave Foo , Marcus Low , Ezekiel Chew ( Pin Bar Strategy that doesn’t works-Scammer), Adam Khoo etc.. comes out still undecided & blurr. ( No offence but the Ultimate truth)

I sincerely like to thank Mr Rayner for the kind efforts that you took the effort to keeps on posting & updates us on the relevant trading materials to us ,former students of yours.

As of now, i can confidently without discretion , analyse any market structure, execute a buy & sell order through your training methods ,technical strategies that you imparted to us without holding back any secrets throughout the training.

Maybe , i am not that smart as other students but your training turns me into one.

Many thanks Rayner & may god bless you always.

Regards

YK Foo

Wow, awesome to hear that Yk!

Thank you for sharing your progress with us!

The material is superb. I have learnt so much from it. My trading journey has improved. Thanks to Mr Rayner.

Glad to hear that Omotayo, keep it up!

Thanks to Rayner!

You’re welcome, anytime!

Looks profitting

For sure!

Hey Rayner.

So, after you identify a strong move to support and you get confirmation with a bearish candle that it is a bull trap, what is your entry criteria for the short?

Is it a market order the next trading day? Or a sell stop? Or sell limit?

Thanks!

Hey Edgard, when Rayner sees a strong move to support, he would be looking to go LONG

Rayner would wait for the price to close within or below the area of support, then wait if the price closes back inside the range.

If it does, he enters the trade at the next candle open! (market order)

Though you can place a buy stop order if you wish

Thanks Sir. I just noticed that I’ve been making a common mistake repeatedly. Anytime my breakouts trade failed and i get stopped out, I then turn to

believe that since the price is in strong momentum high, it’s likely to reverse higher again just after I get trapped.

Anything you post a lesson, I learn a new stuff and correct a mistake. Cheers!!

Great observation Mohammed!

I’m glad this guide helped you out

now i know,im the one who always chasing the breakouts candles 😅and this bull trap pattern is a totally help me a lot,thank you so much gor sharing your knowledge to us🙏

Hah, hope you make some quick changes, you’re welcome!

simple to follow set of rules, written in clear words. thank you. i appreciate your work.

Great to hear that, you’re welcome!

Thanks lot for sharing this knowledge.

You’re welcome, Abhinav!

U are great teacher in stock market

Thank you Shivam!

Good work Mr Rayner I like your training

Thank you Ayuba!

That’s wonderful Rainer, thanks.

You’re welcome, Isameldin!

Its really powerful strat, thank you Rayner i’ve learned more on your TA sharing ideas. More power to you. Many thanks.

You’re welcome, Ronald!

This is so powerful thank you for your endless effort to make sure traders know more secret in the market. GOD BLESS YOU

Thank you for your kind words Odu!

I don’t like the bull trap trading strategy because it’s against my trading rule of never to trade against the current trend.

However, the tips to how to avoid it helps me in my breakouts trades.

No problem Mohammed, I hope this guide helps you in a way!

Patiently wait for the confirmation if it’s through breakout or reversal.

Indeed you are genius.

Thank you for the kind words, Philip!

Rayner you always bring insightful trading tips. Thanks for all you doing

You’re welcome, Anthony!

Clear bull trap explanation

Thank you, Nkebem!

Even though I understand the bull trap pattern, I avoid trading it because, before I identify it forming, I have just gotten stopped out trying to trade the breakout and don’t feel okay psychologically to trade the bull trap almost immediately.

I understand now why most of my breakouts trades fale. Thanks to Ryner Teo 👍👍🙏

Thank you for sharing once again Mohammed, good luck!

Very powerful stuff I’m going to backtest it

Good luck and feel free to keep us updated, Oliver!

nice one rayner God bless you chating from nigeria

Thank you for the kind words Joshua!

Excellent sharing. Clear entry and stop loss levels. Thanks, Rayner

You’re welcome, Victor!

All your posts are very very helpful ,no one teaches like you teach thank you so much brother .

Thank you for your kind words, Ankit!

Buenos días, gracias por toda esta información, he descubierto lo valiosa que es. Tanto que he dejado de intentar aprender de todos los traiders que hasta ahora conocía y a los que he pagado formación. De nuevo le agradezco y me atrevo a sugerirle, si fuera posible, la posibilidad de poder seguir toda su enseñanza en castellano. Disculpen por mi atrevimiento y le les deseo lo mejor a ustedes y sus familias…..