I’m sure you can agree that breakout trading can be exciting.

Especially when you hit the buy button and the market quickly soars higher—whee!

However, there’s also the possibility of the market reversing immediately after you bought, and before you know it—you got caught on a false breakout, argh!

So now…

Won’t it be great if there’s a simple checklist which you can refer to before you place a breakout trade?

This means you can focus on the highest probability breakout trades and avoid the ones likely to fail.

Interested?

Then you’ll want to read every word of this post because you’ll discover the 5 most important things to look for before you place a breakout trade.

Let’s get started…

#1: Trade breakouts in the direction of the trend (for higher probability trades)

Here’s the deal:

When you trade in the direction of the trend, you increase the winning probability of your trade.

In other words, if the price has been moving higher over the last 3 months, then it’s likely to continue higher—and you want to look to buy breakouts (not short breakdowns).

Let me give you a few examples…

#1: Do you want to buy or sell NFLX?

Next…

#2: Do you want to buy or sell AMC?

Now, if you answered “buy” for #1 and “sell” for #2, then you’re right!

Moving on…

#2: Look for a sign of strength, here’s how…

Now to stack the odds further in your favour, you want to look for a sign of strength before buying a breakout (or a sign of weakness before selling a breakdown).

Now you’re probably wondering:

“What do you mean?”

I’ll explain…

When you’re looking for a sign of strength, you want to see a series of higher lows coming into resistance because it signals the buyers are “getting desperate” and wanting to buy at higher prices (which looks like an ascending triangle).

Here’s an example:

And if you’re looking for a sign of weakness, you want to see a series of lower highs approaching support because it signals the sellers are “getting desperate” and wanting to sell at lower prices (which looks like a descending triangle).

Here’s what I mean:

Now, in the real world of trading, you might not always get higher lows into resistance.

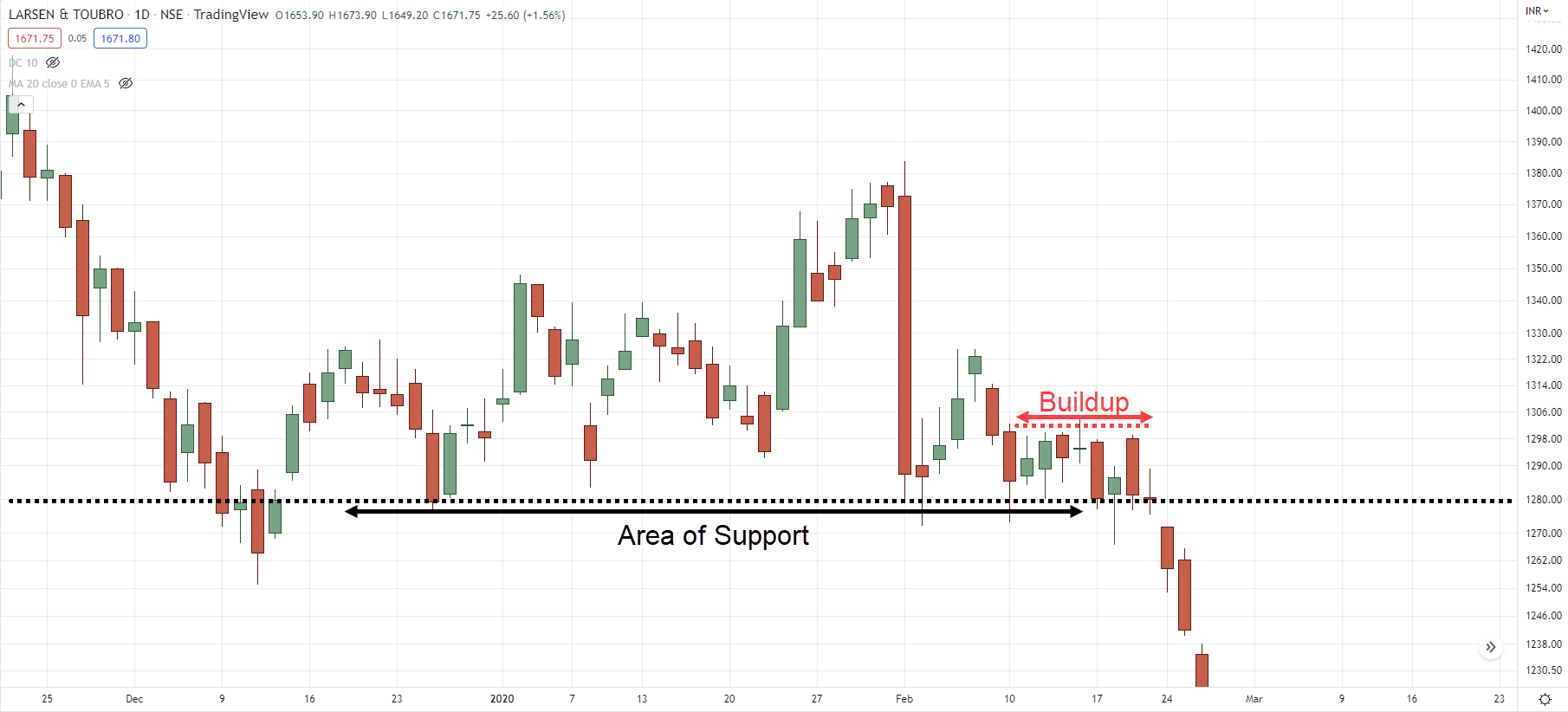

So another variation of it is called, a breakout with a buildup.

Here’s a bullish example:

And a bearish one:

Onward…

#3: Avoid traffic

Let me ask you…

Would you reach your destination faster if there are more or fewer cars on the road?

Of course, you’ll say fewer cars because it means there’s less traffic—which allows you to reach your destination faster, duh!

So, what has this got to do with breakout trading?

Well, it’s the same concept because when you’re trading breakouts, you want to have little incoming traffic, so the price can easily move in your favour.

So what is traffic in trading?

These are areas on your chart where opposing pressure could step in and push the price against you.

Here’s an example:

AMZN broke above resistance but shortly after, there’s a swing high nearby where selling pressure could step in and push the price lower—there’s traffic nearby.

On the other hands, Amazon broke below support and there’s no traffic till the previous swing low.

Does it make sense?

That’s why the most powerful breakouts occur when the price is trading at all-time highs because there’s no traffic to go against it.

#4: A valid entry to time your breakout trade

At this point:

The hard work has been done and your entry is the easiest part of the process.

It can be as simple as buying the breakout above the highs. This means you can simply place a buy stop order above the highs, and if triggered, you’ll get into a trade.

Here’s what I mean…

Alternatively, you can wait for the price to break and close above the highs, and then enter on the next candle open.

Here’s an example:

#5: A sound exit to protect your account and ride massive trends

Finally, you must have a plan for exit.

There are two parts to it:

- Exit when you’re wrong

- Exit when you’re right

Let me explain…

Exit when you’re wrong

This refers to your stop loss.

In other words, you want to ask yourself:

“At which point on the chart will I get out of the trade if the market moves against me?”

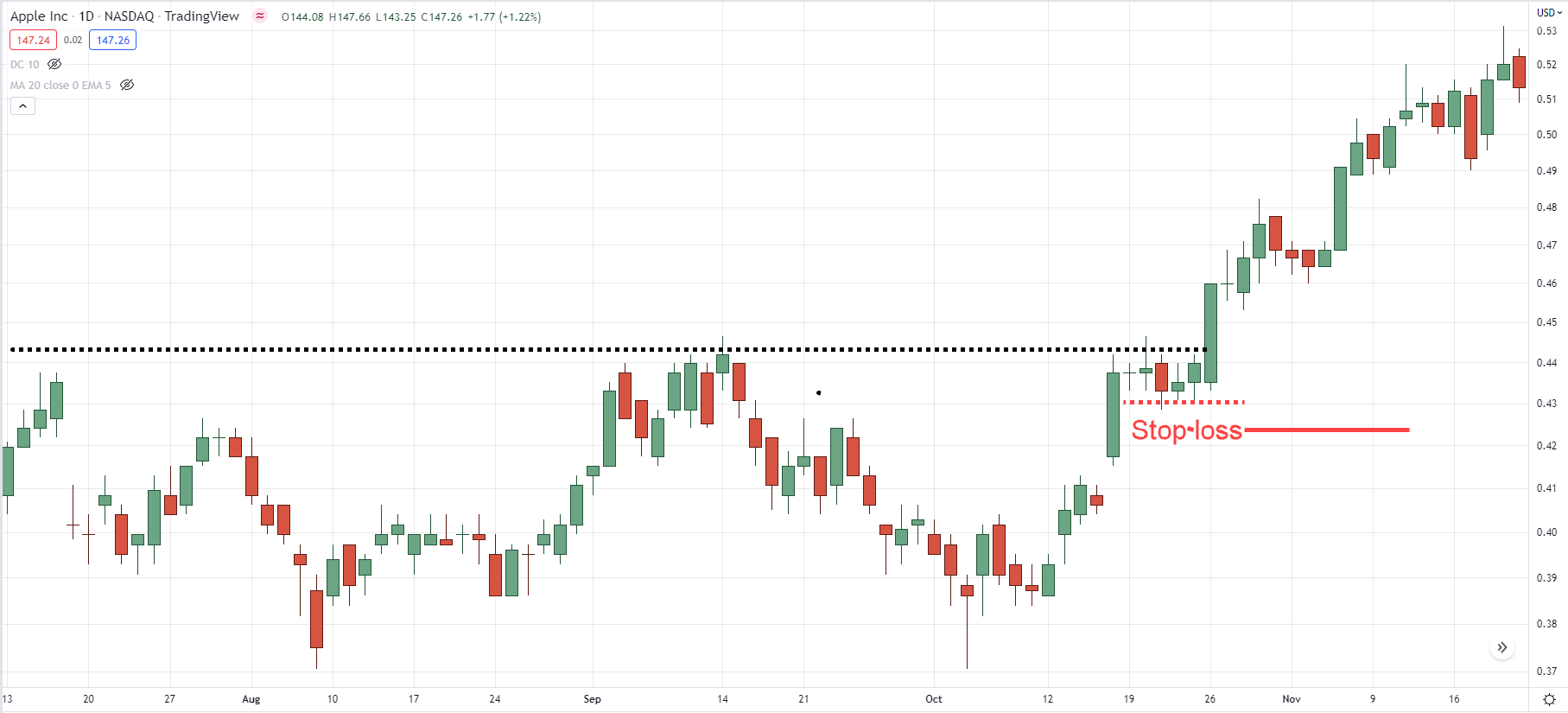

As a guideline, your stop loss should be at a level where if reached, will invalidate your trading setup.

For example, if you’re buying a breakout with a buildup, then your stop loss should go below the lows of the buildup.

Here’s what I mean…

Or, if there’s a series of higher lows into resistance, then your stop loss should go below the previous swing low.

An example…

Next…

Exit when you’re right

On the flip side, what if the market moves in your favour, how would you exit your trade?

My suggestion is to ride the trend for all it’s worth.

After all, you’ve bought a breakout with no traffic ahead of you—which means there’s a good chance of heading higher.

So how should you go about it?

Well, you can use a trailing stop loss like:

- Moving average

- Average True Range

- % drop in price

- Etc.

Here’s an example using the 200-day moving average…

If you want to learn more, then check out 5 Trailing Stop Loss Techniques That Work.

Bonus tip #1: The longer it ranges, the harder it breaks

Here’s why…

When the market is in a range, it’ll attract buyers to buy near support, and sellers to sell near resistance.

Then, the buyers will place their stop loss below support, and sellers will have their stops above resistance.

So the longer the market is in a range, the more stop orders are accumulated below support and above resistance.

So if the price breaks out of resistance, it’ll trigger a cluster of buy stop orders (from the sellers), which adds pressure to the upside.

Also, as the price breaks out of resistance, it’ll attract breakout traders to buy which and that pushes the market even higher.

Here’s an example:

So here’s the lesson…

The longer the market is in a range, the harder it breaks.

If you got caught on the wrong side of the breakout, never average into your losses or widen your stops—that’s a recipe for disaster.

Instead, just cut your loss and move on.

Bonus tip #2: How to trade trend reversal breakout trades like a pro

Earlier:

I said you should trade breakouts in the direction of the trend—and that’s a great way to start if you’re new to trading.

But for the advanced trader, you can also trade breakouts against the direction of the trend (otherwise known as a reversal breakout trade).

This gives you more trading opportunities which could add onto your bottom line.

So here’s how it works:

- The low of the range is leaning against higher timeframe support (this gives you “protection” from the higher timeframe buyers)

- A sign of strength or a buildup at resistance

- Buy the breakout of the highs of resistance

Here’s an example…

Conclusion

As a recap, here’s what you’ve learned:

- Trade breakouts in the direction of the trend so you can improve your winning rate

- Look for a sign of strength before buying breakout or, a sign of weakness before selling breakdown

- Avoid buying breakout into an area with incoming traffic because the market has more difficulty moving in your direction

- Your entry can be as simple as a buy stop order or, waiting for a break and close above the breakout level

- Your stop loss should be at a level which invalidates your trading setup

- A trailing stop loss allows you to ride a trend

Now over to you…

What are some things you look for before you place a breakout trade?

Leave a comment below and share your thoughts with me.

Hi Rayner, I’ve been watching your videos and reading your articles and it’s been a great help for me to understand more the market. for trend reversal breakouts trade, after looking at HTF, should I go for LTF to look for the breakout of the highs of resistance and put my long order at the next candle? Thank you very much.

Hey there Michael, yes that’s right!

You’re the best tutor Rayner ☑️💯

Thank you for your kind words!

Rayner this is excellent…Very grateful. My trading results has been improved day by day.

Awesome to hear that, Vipin!

Hi Rayner, I followed a lit of your videos on utube and I am learning so much from it that I am feeling so confident when I open a trade. I wish I can follow you as my personal trainer until I get there where I want to be

Hey Jonathan, feel free to let me know what areas you need improving, and I’ll do my best to help!

Well, I won’t say this comes late because I learnt my mistake today with these lessons..

Seems like this guide’s on-point, keep it up and learn from it Olamilekan!

Very nice rayner.. Keep the good work, I’ve learnt So much from you❤…so much appreciate 🙏

Thank you for the kind words, Chinwuba!

Great lesson learnt today

Thanks

You’re welcome, Richard!

Would love if you can provide free signals to us been new to trading to perfect our trading skills.

Immediately after the breakout, we could as well wait for a retracement before placing our trades…

If the retracement still finds it difficult to reach the area of value, then we are probably right with our thought…

Great, thanks for sharing, Adewumi!

I have learned a lot after joining you telegram profile I’m so tankful and grateful that chose you as my leader!

Great to hear that Vinod!!