Jesse Livermore is possibly the most famous trader in history.

Born in 1877, Jesse Livermore started trading at the age of 14 and had a net worth of around $100 million at his peak.

However, the story of Jesse Livermore didn’t end well, and he eventually committed suicide.

(If you want to know the full story, go read the book, Reminiscences of a Stock Operator.)

Still, there are powerful lessons you can learn as the trading principles that worked 100 years ago is still valid today.

And that’s what you’re about to discover right now…

“Watch the market leaders.”

Here’s the deal:

If you want to buy stocks, then focus on the strongest ones.

Because these are the ones likely to outperform the market in the future.

Why?

Because Jesse Livermore said so.

Academy research said so.

And Rayner said so.

But nah, that isn’t enough so let’s do a simple backtest to validate it.

Here goes…

Buy rule:

Go long when a stock hits a 50-week high

Exit rule:

20% trailing stop loss

Filter:

Pick the top 20 stocks with the largest price increase over the last 40 weeks (the market leaders)

Sometimes you’ll get too many stocks to choose from. So, a filter like this helps you select which stocks to trade.

Other parameters:

Transaction Costs: $0.01 per share

Test universe: Russell 1000 stocks

Execution: Monday open

Maximum open positions: 20

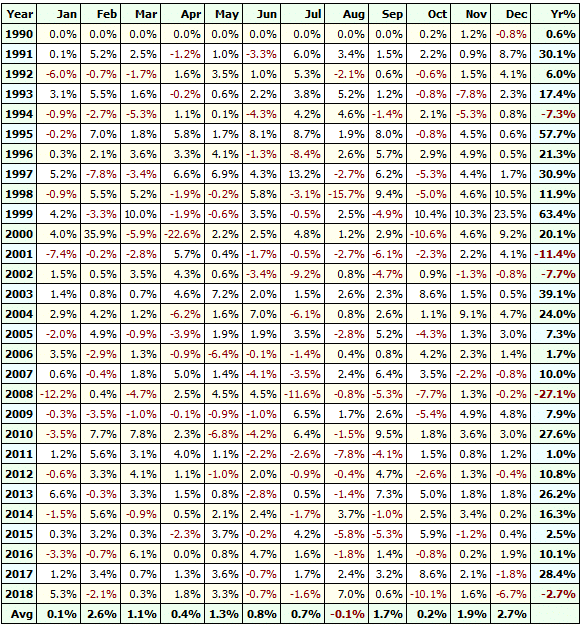

Test period: 1990 – 2018

Positions size: 5%

And here are the results over the last 29 years…

- Number of trades: 710

- Payoff ratio: 2.43

- Winning rate: 48.59%

- Annual return: 12.77%

- Maximum drawdown: 41.73%

As you can see, this simple trading system beats the market (and with lower drawdown).

So the lesson is this:

If you trade stocks, focus on buying market leaders.

Focus on buying the strongest stocks.

Because these are the ones likely to outperform the market.

“What has happened in the past will happen again. This is because Markets are driven by humans and human nature never changes.”

Now, markets are primarily driven by two emotions — greed and fear.

When the market is greedy, you get an uptrend.

When the market is fearful, you get a downtrend.

And when the market is undecided, you get a consolidation or range markets.

Now you might be thinking…

But with the introduction of Algorithms and high-frequency trading (HFT), won’t the market behaviour change?

Well, yes and no.

Yes, the markets have changed in terms of microstructure.

This means the markets are more liquid and less volatile with more players in the market.

But looking at the big picture, the market still behaves the same — it trends up, down, and range.

You might argue…

“But machine don’t have emotions when trading.”

You’re right.

But remember, these machines are controlled by a human — and a human being has emotions.

For example:

If a system does poorly, fear kicks in and the human trader will intervene and pull the plug.

Or if the system does well, greed kicks in and the human trader will trade larger (and even take on more risk).

That’s why Jesse Livermore said…

“What has happened in the past will happen again. This is because Markets are driven by humans and human nature never changes.”

“It was never my thinking that made the big money for me. It was always my sitting.”

Now you might be thinking:

“How the heck does Jesse Livermore make money while doing nothing?”

Well…

What he meant was, when he’s in a trade, he’ll not bother himself with the day-to-day fluctuations of a stock price.

Instead, he’ll sit on his hands and ride the entire trend because that’s how the big money is made.

That’s probably the best way to trade in the early 1900s as transaction costs are high.

Now:

In today’s environment, transaction cost has dropped considerably, and it opens up a whole new ball game.

You can now capture a “small piece” of the move, and with high enough frequency still, make big money.

So don’t limit yourself to the possibilities out there.

“You can win on a stock, but you cannot beat Wall Street all the time.”

Here’s the deal:

All trading strategy will make money in certain market conditions (but not all market conditions).

For example:

- Trend Following in trending markets

- Mean Reversion in range markets

- Etc.

So, your trading strategy makes money when market conditions are favourable to it.

But when market conditions change, your strategy goes into a drawdown and that’s where you lose to the markets.

The solution?

Have proper risk management so you can survive the drawdown and thrive when favourable market conditions return.

Adopt multiple trading systems which perform well in different market conditions. This way, you smooth out your equity returns over time.

“It is what people did in the stock market that counts — not what they said they were going to do.”

Here’s a true story:

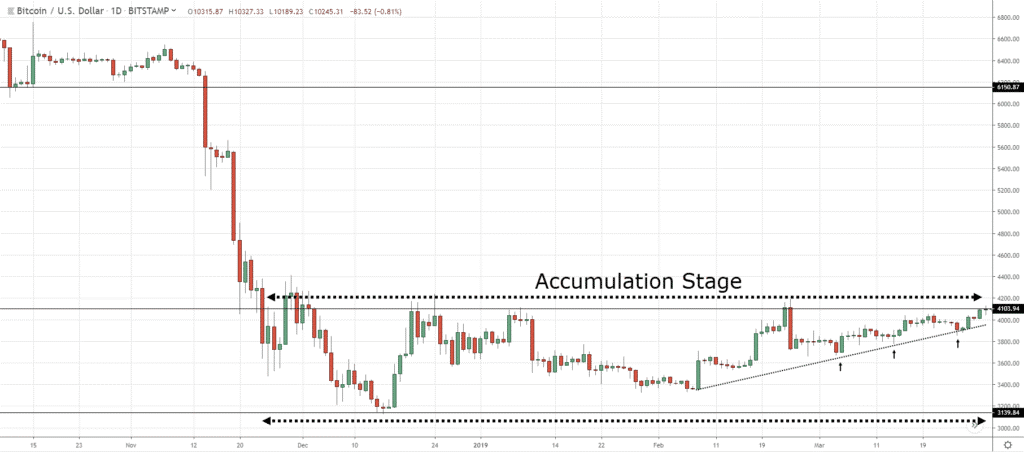

When Bitcoin dropped to the lows of $3500 in February 2019, I wanted to buy into it.

From the chart below, you’ll see it formed a potential accumulation stage with a series of higher lows into Resistance.

Here’s what I mean…

This is a sign of strength to me signalling the buyers are in control and if the price breaks out of Resistance, the market could rally higher.

But the problem is, I don’t have a broker to buy Bitcoin (I’m not talking about brokers who offers Bitcoin CFD because the spread is ridiculous).

So, I did some research and found an exchange that offers Bitcoin.

I was all ready to fund my account, but the paperwork was so tedious.

So I procrastinated…

…and “missed the boat”.

Clearly, I didn’t make a single cent on it.

Anyway, my point is this…

It’s not about what you’re going to do that matters.

What matters is, you did.

“Successful trading is always an emotional battle for the speculator, not an intelligent battle.”

Here’s the deal:

Trading isn’t a battle of the wits.

If it is, then the world of finance would be flooded with mathematicians and PHDs.

(Come to think of it, it’s true. Hah. I have to eat my words now.)

Anyway, you don’t need to be Einstein to succeed in the markets.

All you need is average intelligence.

But one thing you need to be good at is following your rules and have the discipline to execute it consistently.

Here’s why…

Imagine:

You’ve analyzed the market and you’re ready to buy EUR/USD when the price breaks out.

But somehow, you missed the breakout and EUR/USD broke out higher without you on board.

Now, I’m sure you’ll agree it’s not easy watching the markets take off without you.

So each day you tell yourself:

“I’ll enter on the pullback.”

But it never comes.

Instead, the market continues higher and higher.

Finally, you can’t take it anymore and tell yourself…

“Screw this, I’m buying now to catch a piece of the move.”

So, you buy.

The next thing you know, the market collapse and you realized you just bought the highs, ouch.

(This is otherwise known as the fear of missing out, FOMO.)

“I believe the public wants to be led, to be instructed, to be told what to do.”

This Jesse Livermore quote is a century old and still as relevant today.

Here’s why…

If you search “stock trading signals” on Google and you’ll get 44.7 million results — crazy.

Clearly, there are tons of stock trading signals available because there’s demand for it.

Now, the problem with signal service is, you’ll never become a better trader.

When the signals fail, it’s easy to point the blame at them.

And it’s the last thing you want to do because…

If you blame others, it means you’re not taking 100% responsibility.

If you don’t take 100% responsibility, you are giving up your power to change.

If you give up the power to change, you’ll never improve for the better.

Here’s the thing…

You don’t see business owners asking for tips from some 3rd party vendors on how to run their business — and it’s the same for trading.

So, if you want to succeed in trading, you must take 100% ownership and responsibility.

“If you can’t sleep at night because of your stock position, then you have gone too far.”

Now there are a couple of reasons for this and you must avoid it at all costs…

- Over-attachment to money

- Trading with money you can’t afford to lose

I’ll explain…

You’re over-attached to money

Traders who are overly attached to money make a lousy trader.

That’s because the pain of losing money would cause them to break their rules and be an emotional wreck.

If you fall into this group, then my advice is to learn to let go.

I know it’s easier said than done (after all the years of mental programming in your head).

But, it’s the only way forward.

If you don’t detach yourself from the money, then whenever a drawdown comes (which it surely will), you’ll find yourself suffering.

And here’s a fact:

Drawdown occurs about 80% of the time — which means you’ll be suffering most of the time!

So, you must learn to let go.

Detach yourself from the money.

Here’s how…

Go donate money to any charity of your choice (any amount will do).

Next, make a commitment to donate regularly.

Then, slowly increase the amount to donate.

Soon, you’ll find yourself not overly attached to money — and it does wonders for your trading.

Trading with money you can’t afford to lose

I know I sound like a broken recorder, but it bears repeating.

Every trading strategy has a drawdown, and it occurs rather frequently.

Now, you might have a profitable trading strategy but if it’s money you can’t afford to lose, guess what?

You’ll have difficulty following the rules.

This means you’ll widen your stops just to avoid a loss.

You’ll average into your losers hoping to make it all back quickly.

You’ll do stupid things that cause you to blow up your trading account.

So, don’t.

Don’t trade with money you can’t afford to lose.

Don’t use your house mortgage to trade.

Don’t borrow money to trade.

Just don’t.

“Remember that stocks are never too high for you to begin buying or too low to begin selling.”

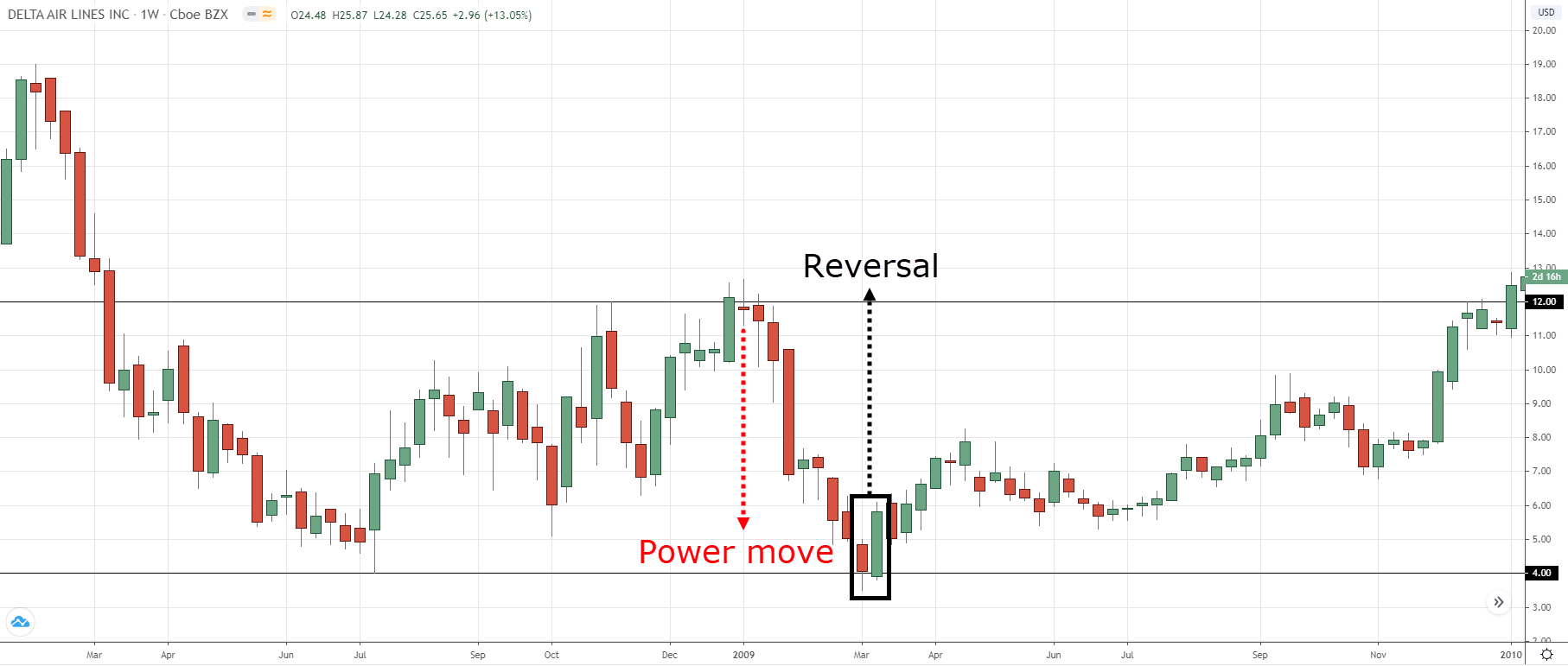

Look at the chart below:

You’re probably thinking:

“The price is so high and the market will reverse soon.”

I get what you mean.

Now, check out the next chart below…

Apparently, what’s high just became higher.

So here’s the lesson:

Buy low sell high isn’t the only way to make money.

Because you can also buy high and sell higher.

And if you embrace both methods, your trading will never be the same again.

“Not taking the loss, that is what does damage to the pocketbook and to the soul.”

There are 4 possible outcomes on your trade:

1. Small win

2. Small loss

3. Big win

4. Big loss

Now, if you can eliminate #4, then you’ve just taken a huge step forward.

Because the small wins will cancel out the small losses.

And what’s left are the big wins that would put your account in the green.

So, don’t focus on winning.

Focus on not getting killed on a single trade — that’s how you win.

“I trade my own information and follow my own methods.”

Here’s the deal:

There are countless trading strategies and methods out there.

And you’re probably wondering…

“So which is the best one for me?”

There’s no such thing because it doesn’t exist.

It depends on your goals, personality and circumstances.

Let me explain…

Let’s say you are working full time and can’t watch the markets all day, then swing or position trading are possibilities to consider.

Or, if you want to trade full-time, then you can consider day trading or scalping.

Or if you want trading to be systematic, then systems trading suits you.

So remember…

There’s no one size fits all when it comes to trading.

You’ve got to figure out what you want first, then adopt a trading method that suits you.

Clear?

“I don’t buy long stocks on a scale down, I buy on scale-up.”

This Jesse Livermore quote tells you he buys stocks in an uptrend — not a downtrend.

In other words, buy high and sell higher.

Now, you might be thinking…

“But what about buy low and sell high?”

Well here’s the thing…

When you buy low-priced stocks, you never know how long it’ll remain low.

It could be weeks, months, years — or forever (as it gets delisted).

And that’s not all…

Because you’re also buying when the price movement of the stock is against you.

Now if you buy stocks in an uptrend, you’ve no idea how long it’ll last.

But at least, it’s moving in the right direction.

The best part?

Academic studies have proven that stocks moving higher tends to continue in the same direction over the next 3 – 12 months period.

Sweet!

“Trading is not a get rich quick scheme.”

You’ve probably heard this a zillion times but still, it bears repeating.

Trading is NOT a get-rich-quick scheme.

So…

- Forget about taking a few hundred dollars and turning it into millions

- Forget about trading full-time on a $1000 trading account

- Forget about making a 50% return every month

Those are marketing gimmicks trying to part you and your money.

If you don’t fall for the hype, then you have a chance to succeed in this business.

“Being a little late in a trade is insurance that your opinion is correct.”

This means you enter a trade only when there’s “confirmation” the price is about to move higher.

Now by waiting for “confirmation”, you’re entering at a higher price but, you have better odds of success.

For example:

If you want to buy at Support, you’ve no idea whether the Support level will hold, or not.

But by waiting for “confirmation” (in the form of reversal price patterns), it tells you there’s buying pressure stepping in to push the price higher.

Of course, there’s no guarantee the price will continue higher even with “confirmation”.

But at least, you’ve got buying pressure coming in which puts the odds in your favour.

Yeah?

“Never average losses.”

Here’s a true story…

Many years ago when I was still a newbie in trading…

I was “playing” with stocks and a particular stock I bought (called Sembcorp Marine) was in the red.

A few days later, my stockbroker called me and said…

“Hey Rayner, you should buy more of Sembcorp Marine since it’s down right now.

You see, if the stock jumps higher, you could get out at breakeven quickly — heck, you might even make a profit if the bounce is strong.”

Now:

What he clearly didn’t mention is what if the stock didn’t rally but instead, continues to slide lower.

Then I’m f*****.

(I didn’t take his advice and sold Sembcorp Marine at a loss.)

Anyway, my point is…

Averaging into losses might get you out of a losing trade quickly.

But, the one time a stock doesn’t return to its previous highs, you’re screwed.

Note: If you know what you’re doing, averaging into losses can work.

But if you’re new to trading, avoid it at all cost.

“Don’t try to play the market all the time.”

Here’s the thing:

A trading strategy only works when the market condition is favourable to it.

For example:

Trend Following works best when markets are trending. If markets are in a range, a Trend Following strategy loses money (and goes into a drawdown).

And as you know:

Market conditions are always changing (from an uptrend to a downtrend, range, etc.).

This means your trading strategy isn’t going to work all the time.

So, don’t think you must always be trading the markets all the time.

Because staying onto cash is a position itself.

“Trade along the path of least resistance.”

This is another way of saying — trade with the trend.

Here’s why…

#1: You increase your winning rate

As you know, a stock that’s moving higher tends to continue higher.

So by trading with the trend (buying a stock that’s moving higher), you increase your winning rate.

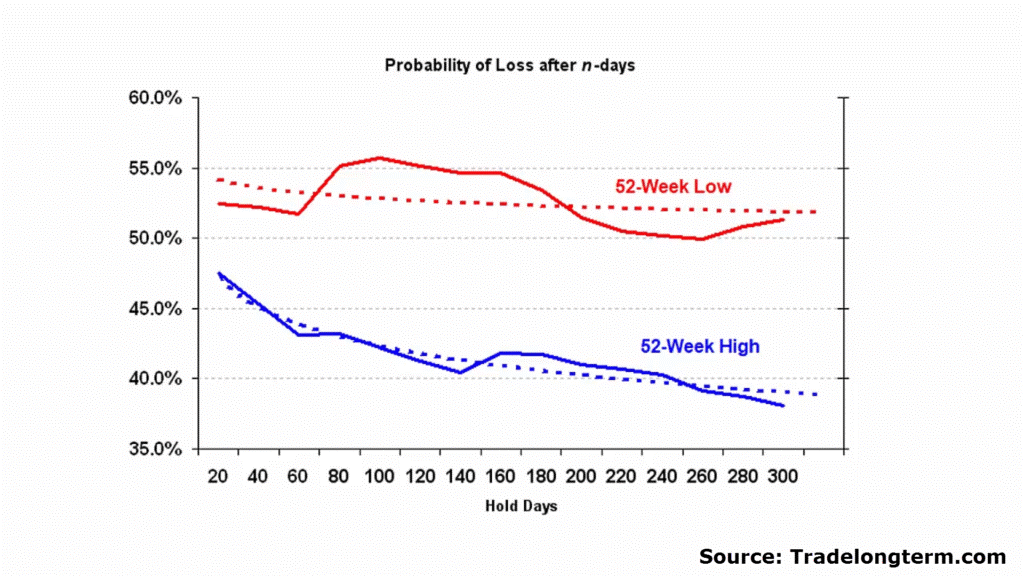

And here’s a piece of research by Nick Radge which shows stocks breaking out of 52-week high have a lower probability of a loss as time goes by.

Red line is buying on a 52-week low.

Blue line is buying on a 52-week high.

X-Axis: Holding time (in days)

Y-Axis: Probability of a loss (in %)

As you can see, the probability of a loss decreases when you buy on a 52-week high.

In other words, your winning rate is improved when you trade with the trend.

#2: You increase your profit potential

In a trending market, there are 2 types of move:

1. Trending move

2. Retracement move

Here’s what I mean:

Now, let me ask you…

Which leg of the trend do you want to trade, the Trending or Retracement move?

I’m sure you’d want to trade the Trending move, right?

Because it lasts longer and offers greater profit potential.

“Markets are never wrong, but opinions often are.”

Have you ever heard traders saying stuff like these?

“Boeing is already at the lows. It can’t go down any lower.”

“I’m not wrong. My fundamental analysis is correct.”

“The market doesn’t know what it’s doing!“

Here’s the deal:

If you play the blame game, you’ll never become a better trader.

You’ll fault the market, the broker, the strategy, etc.

But if you’re willing to accept you can be wrong, then you can make changes and improve.

You’ll respect the markets and accept that anything can happen.

You’ll have a stop loss in place so you don’t let a trade get out of hand.

You’ll adopt proper risk management so you don’t blow up your trading account.

And remember…

Trading isn’t about whether you’re right or wrong.

Instead, it’s about how much you make when you’re right, and how much you lose when you’re wrong.

“I never argue with the tape.”

You’re probably wondering:

“What is the tape?”

A tape is a “machine” that tells the price of a stock (and its delayed prices).

And it’s commonly used in the early days of trading when technology is much simpler.

Anyway…

What Jesse Livermore is trying to say is, never argue with the market.

(But if you read his story, there are times he went against the market and it cost him a fortune).

Here’s how…

1. Always know where you’re getting out of the trade before you get in

2. Get out of the trade when the time comes — no exceptions

Cool?

So, what is Jesse Livermore’s trading strategy?

Here’s the thing:

There aren’t any books that spill out Jesse Livermore’s trading strategy.

But if you read Jesse Livermore quotes and his biography, Reminiscences of a Stock Operator, you’d have a good idea on how he trades the market.

So, let share with you some key principles he adopts in his trading strategy.

(This is solely based on my opinion).

Principle #1: Trade with the trend

This means you want to buy in an uptrend and sell in a downtrend.

A simple technique you can use is the 200-day Moving Average.

If the price is above it, you look to buy.

If the price is below, you look to sell.

Pro Tip:

For stock traders, you can refer to the index to get your bias.

For example…

If you’re trading US stocks, you can refer to the S&P 500 index and see if it’s trading above or below the 200-day Moving Average.

Principle #2: Trade breakouts

There are many ways to trade breakouts.

You can use a stop order, wait for a close above the highs, wait for a buildup to form before it breaks out, etc.

There’s no right or wrong as it depends on your trading strategy.

Principle #3: Ride the trend until it ends

Jesse Livermore started as a scalper in his early days of trading.

Then he evolved as a trader and capture big moves in the market (due to his large trading capital where he can’t enter & exit his trades easily).

So…

If riding trends is your cup of tea, then you can use tools like Moving Average, Market Structure, Average True Range, etc.

Principle #4: Focus on the strongest markets

You’re wondering:

“How do I identify the strongest markets?”

Well, there’s one simple trading indicator that gets the job done.

Introducing… the Rate of Change (ROC) indicator.

The ROC indicator measures the percentage change from X period ago.

For example:

If you use 50-period ROC on the daily timeframe…

This means it calculates the change in the price of an instrument over the last 50 days.

So, one way to identify the strongest markets is to rank them according to the ROC.

Conclusion

And there you have it!

Powerful insights and lessons from a legendary trader, Jesse Livermore.

Now here’s what I’d like to know…

Which is your favourite Jesse Livermore quote and why?

Leave a comment below and share your thoughts with me.

Insightful. Powerful. Clear.

Definitely, awesome to hear that Neil!

“I believe the public wants to be led, to be instructed, to be told what to do.”

How EASY it is to look up, follow, and then blame somebody else’s trading strategy for your own losses.

Sounds like a dumb way to trade IMHO.

Well-said, it’s all about taking responsibility and trading independently!

TQ very powerful insight.

Great to hear that, Naim!

Principle 3# Ride with the trend until it ends

Great, thanks for sharing, Lewis!