#7: Stock Risk Management: How To Calculate Your Position Size

Lesson 7

In this section, I want to discuss risk management for stock trading.

This is an important concept as it doesn’t matter whether you're trading Stocks, Forex, Futures, Bonds or whatsoever.

Risk management is paramount for a trader or speculator.

Let me explain why…

You can have a profitable trading system that makes money, otherwise known as an “Edge.”

But if you do not have proper risk management, then doesn't matter.

You're still going to blow up your trading account.

Let me prove it to you…

Why Risk Management is Paramount to Your Success

Let’s assume that there is this trading system that wins 50% of the time with an average of 1:2 risk to reward ratio.

And let's say that there are two traders, John and Sally.

These two traders trade the same system with a 50% win rate and a 1:2 risk to reward ratio.

And the next 10 trades look something like this:

L L L L L W W L W W

4 winners and 6 losers, a 40% win rate.

Even though there are 4 winners and 6 losers, it does not mean that the system has a 40% win rate because the results are random in the short term.

It’s only in the next 100 to 1,000 trades we get to see the 50% win rate.

John

John is the type of trader that likes to “go big or go home”

He risks 20% of his account on each trade and encountered these series of trades:

L L L L L W W L W W

Now, John’s account would look something like this:

-20% -20% -20% -20% = -100%

Clearly, before he can reach his 6th winning trade, he would already be wiped out.

He would blow up his trading account.

On the other hand…

Sally

Sally is a conservative trader.

She's more careful and applies proper risk management.

She plays good defense so she would only risk 1% on each trade.

So, Sally’s account would look something like this:

-1% -1% -1% -1% +2% +2% -1% +2% +2% = +2%

You can see That Sally had a positive outcome of 2% with a 1:2 risk to reward ratio.

Can you see the difference over here?

John is an aggressive trader who blew up his trading account with 20% risk per trade

Sally, on the other hand, risked only 1% on each trade and ended up with a net profit of +2%

Can you see the lesson I'm trying to bring across on how risk management would keep you through the tough times?

Risk management is what will help you survive your losing streak.

Risk management is what will make you still stand strong right even though the market conditions are unfavorable to you.

Because as I've just shared with you…

A profitable trading system without proper risk management will still cause you to lose in the long run.

Now the question is…

How do you put on your trades in such a way that when the trade hits your stop loss, you lose not more than 1% of your trading account?

Here’s the answer…

How to position size your trades for stocks

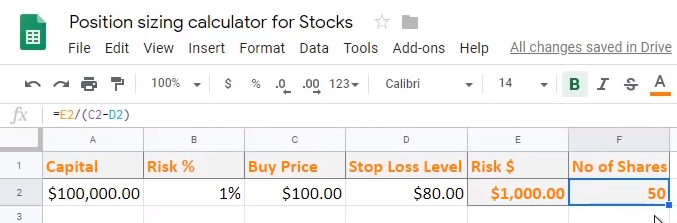

This is a spreadsheet that I have developed myself…

You can simply just Google “stock trading position sizing calculator” and you probably can find something similar or even better than this.

So what you’d do is to fill in the following columns in order…

- Your trading capital ($100,000)

- Your risk per trade (1%)

- Your buying price on the stock ($100.00)

- Your stop loss price ($1,000)

Your Risk $ column is already calculated based on your capital and the risk column.

Now…

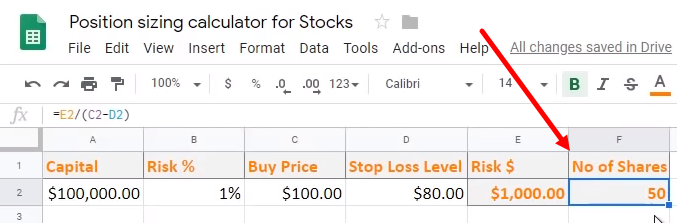

If you take your Risk $ and divide it by your stop loss level ($80.00) minus your buy/entry price ($100), you get 50 shares…

What this means is that if you put on the trade, set your entry price ($100) and set your stop loss price ($80) at eighty dollars…

You would need to buy 50 shares so that if the trade hits your stop loss, you won’t lose more than $1,000 on the trade (which is 1% of your trading capital).

One thing to point out is that the number of shares you buy is never fixed.

It’s dependent on the distance of your stop loss to your entry.

Why?

The tighter the stop loss, the higher the number of shares you can buy.

While if you increase the distance of your stop loss relative to your entry, the fewer shares you can buy while still keeping your risk constant.

Needless to say, if you increase your risk like John, which is 50%, you can buy more shares.

At the same time, you risk losing 50% of your account in this case if the trade does not go your way.

With that said, let's do a quick summary, shall we?

Summary

- Risk not more than 1% of your trading capital

- The tighter your stop loss, the larger your position size

- The larger your stop loss, the smaller your position size